The transfer is something where an asset is being moved. This movement can be a physical movement of an asset and/or a movement in the ownership of the title of the asset. Now, in the case of securities, it can be voluntary or mandatory by law. The transfer of shares is a voluntary act that can be initiated by the shareholder, and it takes place through the process of the contract.

Now, if we talk about share transmission, then the transmission of shares is a bit different; it takes place due to the provisions of the law on the death of the shareholder or in the event where the holder becomes bankrupt or lunatic. Now, let’s look at the conceptual difference between the transmission of shares and the transfer of shares.

What does Transfer of Shares Means?

When the intentional transfer of title of the asset or share occurs between the transferor and the transferee, it is known as the transfer of the share. Here, the transferor is the one who transfers, and the transferee is the one who receives the ownership.

Only if a public company disallows the transfer of its shares for some valid reason then its shares can’t be transferred; otherwise, they can be transferred freely. Now, if we talk about private companies, then the shares of a private limited company can’t be transferred except in some exceptions. However, a transfer deed is required for the transfer of shares.

What does the Transmission of Shares Means?

As we stated above, transmission of shares takes place as per the provisions of law. So, if the holder does not live longer or has become insane or insolvent, then the transmission of shares will be done. Even if a company is the holder of the shares, it may fail to survive.

There is no need to execute the transfer deed, and the transferee (one who receives) will receive rights of the shares, and the transmission will be only recorded when the transferee presents proof of entitlement to the shares.

In case of the death of the shareholder, it will be transferred to a legal representative, and in case of bankruptcy, it will be transferred to the official assignee.

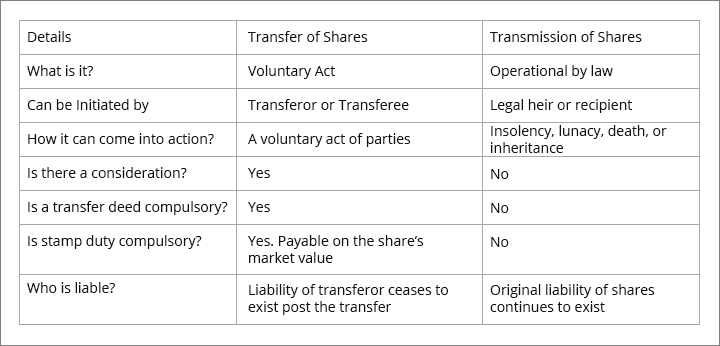

The following table will shed more light on the difference between the transfer and transmission of shares

While we are talking about Transfer and Transmission of Securities, let’s take a look at the concerning provisions.

Provisions Under the Companies Act, 2013 and Companies (Share Capital & Debenture) Rules, 2014

According to Section 56 of the Companies Act, 2013, read with Rule 11 of Companies (Share Capital & Debenture) Rules, 2014

Read Also: Shares and Debentures: Similarities & Dissimilarities

Definition: Transfer of Shares

This will come into action only when a proper instrument of transfer, in Form SH-4, as addressed in sub-rule 1 of Rule 11 (Share Capital and Debentures) of Companies Rules, 2014, is duly stamped, dated, and it is executed by or on the account of the transferor and the transferee and stipulates all the necessary details such as name, address, and occupation, if any.

It needs to be represented in front of the company by either participant within 60 days from the date of execution, and it also needs to have a certificate of securities or a letter of allotment of available securities.

If the transferor applies to the transfer of partially paid shares, then notice of application will be given to the transferee by the company in Form SH-5 as described in sub-rule 3 of Rule 11 (Share Capital and Loan) Rules 2014 of the Companies Rules 2014. And the transferee should have no objection to the transfer within 2 weeks from the date of receipt of the notice.

Dedicated SAG RTA Team to Handle Client Transactions and Queries

Appoint SAG RTA as Your RTA Service Provider Now

Appoint RTA Agent NowDefinition: Transmission of Shares

This will come into action when the application for transmission of shares, along with related documents, is found valid. And there is no need to execute the transfer deed.

Transmission of shares requires the following documents

- Death Certificate’s Certified Copy

- Copy of PAN (Self-Attested)

- Succession certificate/ Will/ Probate of Will/Letter of Administration/ Court Decree

- Specimen signature of the successor

Deadline for Delivery of a Certificate in Both Cases

In case of transfer of shares, Certificates of all securities should be transferred or transmitted within one month from the date of receipt of the instrument of transfer by every company or intimation of transmission notice as applicable, unless restricted by any provision of law or by any tribunal or court order or order by any other authorities.

Penalty for Non-Compliance

In the event of any omission in compliance with the above, the penalty on the company shall not be less than ₹ 25,000, but may increase up to ₹ 5,000,000, and every officer of the company who is in default shall be punishable with a penalty of less than ₹ 10,000, which can also be increased up to ₹ 1,00,000.

While these two are meant to change the ownership of title to the shares, the major difference between the transfer and transmission of shares is the fact that the transfer of shares is voluntary, and can be initiated by a transfer or transferor. While the transmission of shares is in accordance with the provisions of the law, and may be initiated by a legal representative or receiver.