On June 21, 2023, a circular was issued by the Securities and Exchange Board of India (SEBI). It states new regulations for issuing units of Alternative Investment Funds (AIFs) in the form of dematerialization.

The action is a crucial move proposing to enhance transparency and protect investors. In the Circular, deadlines and compliance requirements for these modifications in the SEBI (AIF) Regulations, 2012 are clearly defined.

SEBI is introducing a revolutionary modification in the operating dynamics of AIFs. In this article, we have tried to cover everything about the issuance of units of AIFs in dematerialized form.

Alternative Investment Funds

Alternative investment funds refer to investment vehicles that accumulate money from organised investors and distribute it among different financial securities following a pre-determined investment strategy. The primary goal of these funds is to diversify investors’ portfolios and provide adequate returns to assist them in making their dreams come true regarding financial goals.

People with high net worth and institutions often position their money in such types of investment vehicles. Following specific requirements, individual investors can also invest in an AIF.

Dematerialization Process

Dematerialization is the process through which physical shares and securities can be transformed into digital or electronic forms, allowing them to be stored in a Demat Account. The primary objectives of dematerialization are to enhance the convenience, cost-effectiveness, and accuracy of buying, selling, transferring, and holding shares. Instead of physical share certificates, all your securities are securely managed in an electronic format.

A depository is responsible for keeping a shareholder’s securities secure in electronic form. A registered Depository Participant (DP) holds these securities. As per the Depositories Act of 1996, DP is a depository agent who provides depository services to traders and investors.

There are two Depositories under SEBI Registrations that are authorised to operate in India

- Central Depository Services (India) Ltd. (CDSL)

- National Securities Depository Ltd. (NSDL)

Holding certificates in Physical form bears some risks, including certificate fraud, the loss of valuable certificates, and delays in certificate transfers. You can get rid of many such inconveniences through dematerialization by converting your physical certificates into an electronic format.

Read Also:- Shares Dematerialization and RTA: Now An Indispensability

Why is Dematerialization Necessary?

Monitoring paper-based documentation can be challenging, and there is a risk of overlooking important documents due to the daily piling up of paperwork.

Duplicate certificate generation, in case of loss, is both time and cost-efficient. Dematerialized shares receive credits and bonuses straight into the respective accounts, eliminating the risk of loss during transit. This also leads to lower interest rates for loans related to Demat accounts.

Under the SEBI (Alternative Investment Funds) Regulations, 2012, AIFs/schemes of AIFs can raise funds from any investor by issuing units that represent the investors’ beneficial interest in the scheme.

However, it has been observed that a significant number of AIF units are still held in physical form and have not been converted through dematerialization. In the interest of the investors, SEBI has mandated dematerialization through its latest circular.

Key Points Stated in The Circular

Alternative Investment Funds (AIFs) are required to issue units in electronic form according to AIF Regulation 10(aa), with potential constraints SEBI may impose from time to time.

The following details are specified concerning the matter:

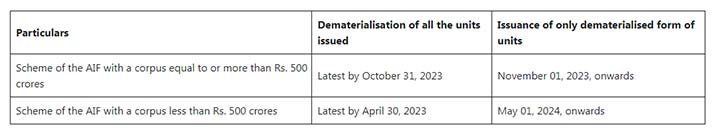

Revised AIF regulations mandate the dematerialization of all AIF schemes. The timeline for implementation is specified based on the AIF corpus size. Plans with a corpus of Rs 500 crore or more need to be carried out before the last date, which is October 31, 2023. For schemes with a corpus of less than Rs 500 crore, the deadline is extended to April 30, 2024. Issuance of units in the dematerialized form must be done only after these specified dates.

An exception to this requirement applies to schemes whose term (excluding authorised extensions) ends on or before April 30, 2024.

Read Also:- Complete the process to Register With SEBI For The RTAs

The terms of transfer for AIF units held electronically by an investor will be regulated by the Private Placement Memorandum (PPM), AIF-investor agreements, and other fund documents.

Guidelines to The Depositories

The depositories under the circular would be directed to:-

- The relevant bylaws, rules, and regulations must be changed by the depositories in order to carry out the aforementioned provisions.

- Build a system to ensure that any AIF unit transfer held in the dematerialized form that would be concerned with the Private Placement Memorandum, agreements incurred made between the AIF and the investors, or any additional fund documents would be taken as per the foregoing, that is, after the AIF/manager of the AIF approval.

- Post the provisions of this circular on their websites and inform their participants and members.

The SEBI Intermediary Portal requires the management of AIF to provide a report on compliance with the conditions of this circular in the manner specified there. In accordance with the circumstances, the sponsor and trustee of the AIF should make sure that the “Compliance Test Report” provided by the management is in accordance with SEBI Circular No. CIR/IMD/DF/14/2014, dated June 19, 2014, includes conformity with the terms of this circular.

Closure

The circular shall be effective immediately. This circular is being published in line with the power provided by Section 11(1) of the Securities and Exchange Board of India Act, 1992, in order to safeguard the interests of investors in securities, promote the expansion of the securities industry, and regulate the securities market.

Dematerialised Form AIFs Units FAQs: –

Q.1 – What Does the Term Dematerialisation Identify?

Dematerialization is the process through which physical shares and securities can be transformed into digital or electronic form and kept in a Demat Account. The main objectives would be to eliminate errors in the buying, selling, transferring, and holding of shares and be cost-effective and error-free. All of your securities are stored in electronic format rather than as physical certificates..

Q.2 – What Does the Alternative Investment Fund Identify?

Investment vehicles known as alternative investment funds are used to disperse capital from affluent individuals across a variety of financial instruments in line with a preset investment plan. The main aims of such a fund are to diversify investors’ portfolios and offer adequate returns to aid in their achievement of financial goals.

Q.3 – Who are the Two Depositories Registered with SEBI?

A. Central Depository Services (India) Ltd. (CDSL) and b. National Securities Depository Ltd. (NSDL) is the two depositories with SEBI registrations and operating permits in India.

Q.4 – From Where Should I Purchase & Compare ITR Filing Software?

There are many income tax returns preparation software applications that are remarkably easy to use. You can work it on your own with the directions given, either you also take the help of free trial sessions to be easier with this software.

Q.5 – What Additional Criteria Apply to All Aif Systems That Call for Unit Dematerialization?

As per the AIF Regulation 10(aa), AIF would be required to issue units in dematerialized form with regard to any conditions of SEBI that might be levied over time. October 31, 2023, would be the due date for plans with a corpus identical to or exceeding Rs 500 cr and would get prolonged to 30th April 2024 towards the schemes with a corpus of lower than Rs 500 cr. Post these dates all units must be issued in the form of dematerialization.