What is Registrar and Share Transfer Agent (RTA)?

RTA, or the Registrar and Transfer Agent, is the authorised institution established for maintaining complete records and transferring shares to investors, providing detailed information to mutual fund houses and facilitating their operations.

The mutual fund houses process the transactions of investors, while all data generated from these transactions is maintained by the registrar and share transfer agent.

Here, the data is referred to by all the buying/selling records, i.e. share transfer process, changes in the personal data, processing of emails and exchange of communication with the investors occurring frequently.

Such maintenance of data and record-keeping is beneficial for the mutual fund houses to keep the focus on their mainstream work while saving cost and time.

Registrar & Share Transfer Agent also provides the latest information to the investors based on changes in the procedure, market fluctuations or any offers available for them to avail.

SEBI, i.e. the Securities and Exchange Board of India, is a key authority in designating RTA, its work assignment and is based on guidelines enacted in the Securities and Exchange Board of India (Registrars to an Issue and Share Transfer Agent) Regulations,1993.

Read More: Registrar and Share Transfer Agents & Their Roles With Stakeholders

Let Us Understand the Procedure to Register and Share Transfer Agents with SEBI:

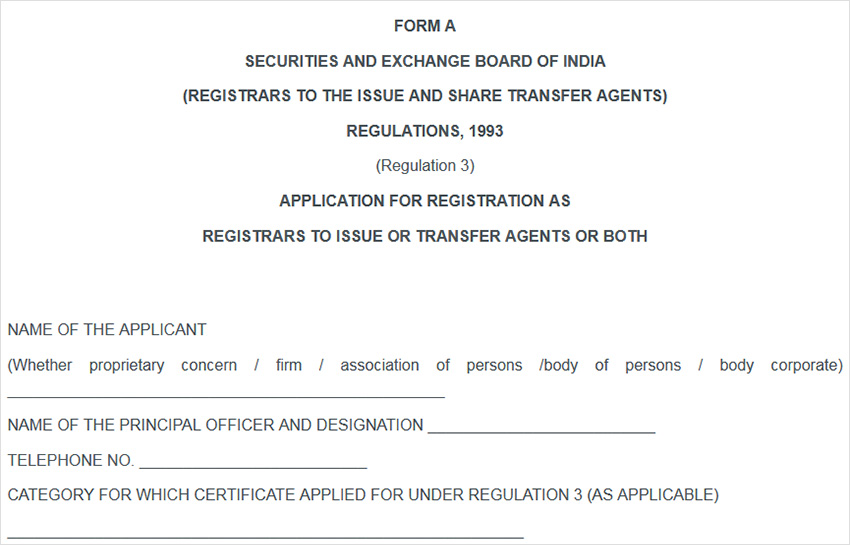

- First of all, the applicant will have to file for registration with Form A along with the prescribed non-refundable fees of INR 6 lakhs for category 1 and INR 2 lakhs for category 2.

- After which, the board will require certain specific information as per the prescription and would also require the applicant to be present in person in the board office.

- The board is authorised to cancel any application it finds not suitable or if there are any shortcomings in the application. Also, the board can give a second chance to the applicant to fulfil the conditions within a prescribed time framework.

Procedure:

1. Application for Grant of Certificate

An application by a registrar to an issue and share transfer agent for a grant of certificate is required to be made to the SEBI Board in Form A.

2. The application for registration as a registrar to an issue or transfer agent can be made under the following categories to the SEBI:

- Category 1: Act as both registrar to an issue and a share transfer agent

- Category 2: Act as either a registrar to an issue or a share transfer agent

3. Unlike all the relevant aspects covered in the sub-regulation (1), any of the applications filed by a registrar to an issue or a share transfer agent before actualising such regulations having points resembling those mentioned in Form A must be received as an application in accordance with sub-regulation (1), also taken correspondingly

4. To Get More Detailed Information

4.1 The Board may ask the applicant to provide further details regarding the activities or matters that are relevant to the application for the grant of a certificate.

4.2 The Board (SEBI) may ask the applicant or its principal officer to appear in person before the Board for personal representation if required.

5. Application to Confirm the Requirements

Any application that does not complete or meet the necessary aspects and instructions specified in Form A shall be rejected as per the provision of the sub-regulation (2) of regulation 3 mentioned in the SEBI Act 1992.

However, the Board will offer an opportunity to the applicants whose application does not meet the necessary aspects and instructions specified in Form A. The applicants must eliminate the obstacles specified by the Board within a given time period.

6. Consideration for Application

The Board must take into account all the necessary matters or activities for considering the grant of a certificate to applicants, in particular in the following cases, whether the applicant-

- has the mandatory infrastructure facilities like adequate premise space, equipment, and manpower;

- has experience in the relevant area;

- or any other person, who is directly or indirectly linked to the applicant, has not been granted registration earlier by the Board under the Act;

- meets the capital adequacy needs, encoded in regulation 7;

- is marked for disciplinary actions under the SEBI Act, or any of its partners, directors or principal officers has been charged for any offence, which includes moral turpitude or has been denounced for any economic fraud.

7. Capital Adequacy Requirements

7.1 The capital adequacy requirement mentioned in clause (d) of regulation 6 shall not go below the net worth of the applicant, as highlighted in sub-regulation (2).

7.2 As per the sub-regulation (1), the net worth of the applicant for the two different categories is given below:

- Category 1: As per clause (a) of the sub-regulation (2), which is again a sub-part of regulation 3, the net worth for an applicant must be INR 50 lakh.

- Category 2: As per clause (b) of the sub-regulation (2) of regulation 3, the net worth of the applicant must stand at INR 25 lakh.

7.3 As per the sub-regulation (3), the term ‘net worth’ denotes:

In case the applicant is a firm or association of persons or any body of individuals, the total value of capital contributed to such business by the applicants, and free reserves of any kind to their business, denotes net worth.

In the case of a corporate body, the value of free reserves and paid capital mentioned in the account books of the applicant at the time of submission of the application, as per sub-regulation (1) of regulation 3, counts as the total net worth.

8. Registration Procedure

The Board (SEBI) post-assessment that the applicant is eligible is required to send the notice/information to the applicant about the category for which they are eligible for the grant of a certificate, as well as the grant of a certificate in Form B, depending upon payment of the fee as depicted in regulation 12.

9. Certificate Renewal and its Conditions

The registrar to an issue or share transfer agent may, if he so desires, make an application in Form A for renewal of the certificate before three months of the expiry of the period of the certificate.

9.1 The registrar or share transfer agent can also make an application for the renewal of a certificate in Form A before three months of the expiry of the certificate.

9.2 The renewal application must be dealt similarly by the Board as if it were an application for the grant of a certificate under regulation 3.

9A. Conditions of Registration

The conditions mentioned below are applicable for any registration granted in accordance with regulation 8 or any renewal granted under registration 9:-

- When the applicant requests to change its status or constitution, it must obtain the prior permission of the Board to work with the same power after the change

- The applicants must pay the fee for registration or renewal in a manner that is consistent with the SEBI regulations

- The applicants must fulfil the capital adequacy requirements encoded in Regulation 7 of SEBI provisions at all times after the grant of the certificate until its expiry.

- It shall also take necessary actions for redressal of grievances of the investors within a time span of one month and subsequently inform the Board about the important details of complaints, like a number, etc. and the manner in which they have been tackled.

- It shall also comply with the regulations depicted under the Act in response to the activities carried out by it while working as a registrar to an issue or share transfer agent.

10. Procedure, in Case Registration is not Granted

10.1 When the application for registration or renewal does not meet the prespecified requirements or guidelines encoded in regulation 6, the Board is allowed to reject the application after being given a reasonable opportunity of being reheard.

10.2 The refusal to grant or renew the certificate is provided to the applicant within three days by the Board, along with the valid reason for rejection.

10.3 Any applicant who believes the rejection is unfair can reapply to the Board under sub-regulation (2) within thirty days from the date on which it receives the receipt of such rejection from the Board after consideration.

10.4 On receiving the applicant’s request receipt under the sub-regulation (3), it becomes pivotal for the Board to reconsider the application and communicate the findings in a written format to the applicant as soon as possible

11. Effect of Refusal to Grant or Renew the Certificate

Any applicant whose application for a grant or renewal of a certificate to operate as registrar to an issue or a share transfer agent is declined by the Board shall, on and from the date of receiving the rejection receipt, cease any activity as a Registrar & Transfer Agent under sub-regulation (2) of regulation 10.

12. Payment Fees and Pay Fees Failure Consequence

12.1 Every applicant who has applied for a grant or renewal of a certificate to operate as an RTA must pay such fee in a manner and within the specified time period mentioned in Schedule II.

12.2 In case an applicant fails to pay the fee as mentioned in sub-regulation (1), the Board has the power to cancel or suspend the applicant certificate; thereafter, the registrar and share transfer agent must stop all their activities as an RTA.

Dedicated SAG RTA Team to Handle Client Transactions & Queries

Appoint SAG RTA as Your RTA Service Provider Now

Appoint RTA Agent NowFormat of the Registration Form:

SCHEDULE I

Instruction:

- The applicant must submit a completed application form, along with supporting documents, to the Securities and Exchange Board of India.

2. All columns of the application should be filled in. In case a column is not relevant or not applicable, this should be specified.

3. The information that needs to be supplied in more detail may be written on separate sheets, which should be attached to the application form.

4. The form of the original copy duly signed should be submitted.

PART – I

1. Applicant’s Details

2. Organisation Structure

2.1 Objective of the organization.

(Attach the extracts from relevant documents like Partnership deed, Charter, Memorandum of Association, and Articles of Association in support of the objectives of the organisation.)

2.2 Date and Place of Incorporation / Establishment of the organisation of the applicant.

Day Month Year Place

2.3 Applicant status (specify whether proprietary, partnership, an association of persons, body of individuals, the limited company – public/private, others. If listed, the name of the stock exchange and the latest share price (high & low).

2.4 The functional responsibility of an organisation is charted at various levels.

2.5 Particulars of all Proprietors / Partners / Managers / Officers / Directors:-

[Experience, Name, Qualification, Date of Appointment, Other directorship (Name & Date of Appointment), Previous positions held.]

2.6 Number of employees

(General and for specific Intermediaries activity)

2.7 Name and activities of associate companies/concerns carrying out activities of a registrar to issue or share transfer agent.

Name Address/

Phone nos. Type of activity Status

2.8 In case the applicant is a body corporate, please give a list of major shareholders (holding 5% or more voting rights) and the percentage of their shareholdings.

3. Details Of Infrastructural Facilities

3.1 Office Space (mention the extent of the area available)

3.2 Office Equipment (mention the details of electronic office equipment, typewriters, telecommunications equipment, etc.)

3.3 Whether Data Processing capacity facility is available (a) In-house or (b) outside, please give details.

3.4 Computer facility:

(a) Hardware Configuration

(b) Software Environment

4. Business Plan (For 3 Years)

(a) History, Major achievements and present activity

(b) Projected Profitability (Next three years)

(Physical targets, Modus Operandi to achieve targets, Resultant Income)

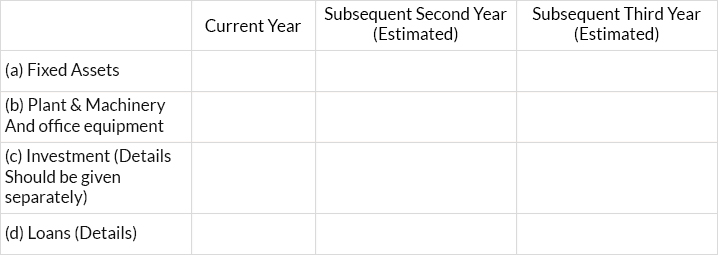

5. Financial Information

5.1 Capital structure

(Rs. In lakhs)

Note: – In case of a partnership or proprietary concerns, please indicate capital minus drawings.

5.2 Deployment of Resources

(Rs. In lakhs)

5.3 Net Profit for the last three financial years

(Rs. In lakhs)

5.4 Estimated profit from various sources Rs. In lakhs)

5.5 In the case of a body corporate, please enclose three years of audited annual accounts and where unaudited reports are submitted, give reasons.

5.6 Name and Address of Principal Bankers

5.7 Name and Address of the Auditors (Internal, External & Tax auditor, if any).

(As applicable)

6 Other Information

6.1 Details of all pending disputes:

6.2 Indictment of involvement in any offence relating to moral turpitude / economic offences in the last three years.

6.3 Any significant awards or recognition, collective grievances against the services rendered by the company.

6.4 Any other information considered relevant to the nature of services rendered by the company.

6.5 Name of two references.

(For applicants other than institutions & corporate bodies)

Part II

7. Business Information

7.1 Describe present activities and proposed activities in the case of a new organisation.

7.2 Existing/proposed facilities for redressal of Investor Grievances.

(Complaints, Furnish number received, follow-up with the companies, the average time taken in resolving the complaints and overall system of handling complaints.)

7.3 Enclose a copy of a typical contract entered with a person making the issue or share transfer agent.

7.4 Details of facilities for processing of the application, collection, and dispatch of documents, refund orders, allotment letters, space for the safe custody of refund orders, certificates, and reconciliation with the collecting banks.

8. Experience

8.1 Experience in handling the activities during the last three years.

(Name of the corporate body, particulars of issues handled, size of issues, etc.) for:

(a) Registrars to Issue

(b) Share Transfer Agents

8.2 Experience in other financial services (period, area, and commencement of activity).

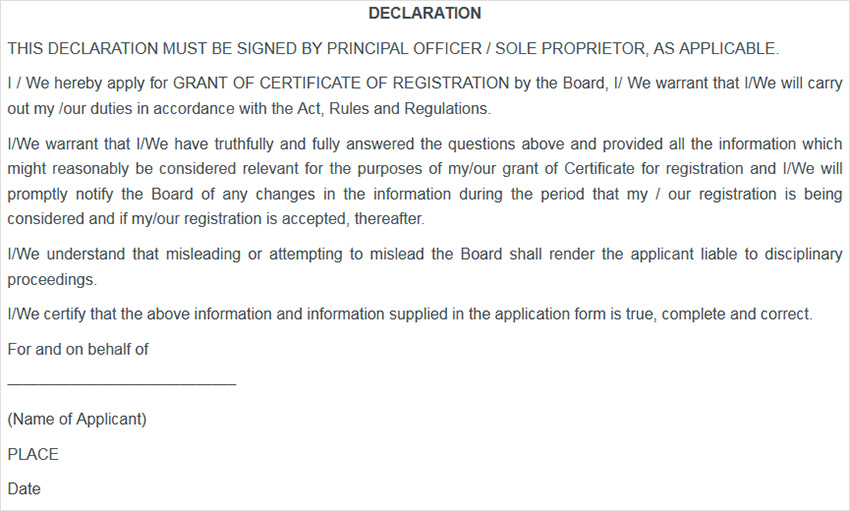

Declaration:

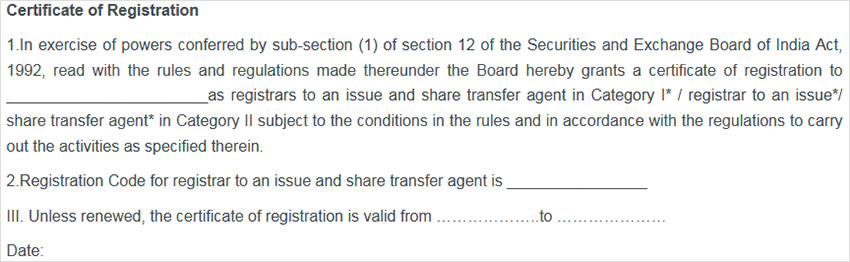

After all the documentation, the SEBI grants registration in Form B, along with the payment of the prescribed fee.

FORM B

SECURITIES AND EXCHANGE BOARD OF INDIA

(REGISTRAR TO AN ISSUE AND SHARE TRANSFER AGENT)

REGULATIONS 1993

(Regulation 8)

Certificate of Registration

By Order

For and on behalf of

Securities and Exchange Board of India

SCHEDULE II

SECURITIES AND EXCHANGE BOARD OF INDIA

(REGISTRARS TO AN ISSUE AND SHARE TRANSFER AGENT)

REGULATIONS, 1993

(Regulation 12)

Fees:

Every registrar to an issue and share transfer agent must pay the registration fees as given below:

1 (a) Every registrar and share transfer agent who belongs to Category I must pay a registration fee of INR 3 lakh at the time of grant of certificate to the Board, and also pay a renewal fee of INR 1 lakh 50 thousand after every three years from the fourth year post their registration.

(b) The applicants belonging to Category II, as depicted in sub-regulation (2) of regulation 3, are again compelled to pay a total of INR 1 lakh to the Board at the time of grant of certificate and also pay a sum of INR 50 thousand from the fourth year onwards as a renewal fee for the grant of certificate.

2.(a) The registration fee mentioned above must be paid by the applicants within fifteen days starting from the date of receiving the acknowledgement receipt from the Board.

(b) In case of the renewal free as discussed above, it would again be paid in 15 days by the applicants from the date when they receive information from the Board regarding their renewal acceptance under the sub-regulation (1) of regulation 9.

2A. The non-refundable fee payable along with the application is INR 10 thousand, which must be paid for the grant or renewal of a certificate to operate as a registrar to an issue and share transfer agent

3. The fees specified above should be paid in demand draft form in favour of ‘Securities and Exchange Board of India’, payable at Mumbai or at the respective regional offices.