Recently the government of India as well as SEBI has brought some of the major changes in the mutual fund compliance and the share market sector due to corona virus pandemic. SEBI has issued various circulars and guidelines in order to keep updated all of its concerned associations and stakeholders.

Let us check out the circulers issued in the view of Covid 19:-

Latest SEBI Circular for “Relaxation on levy of additional fees in filing of certain forms under the copanies act 2013 and LLp Act 2008″

Recently the MCA has come up with the extension of due date of form PAS 6 as per the circular which was notified on 3 may 2021 stating the revised due date of 31st July 2021 for all the form PAS 6 filing.

Addendum to SEBI Circular on “Relaxation in adherence to

prescribed timelines issued by SEBI due to Covid 19” dated April 13,

2020

- On 13, April 2020 SEBI has given circular no SEBI/HO/MIRSD/RTAMB/CIR/P/2020/59 in which “Relaxations in adherence to prescribed timelines” for carrying out numerous shareholders requests and for other law filings were provided to RTA (Registrar and Share Transfer Agent) in context to covid-19.

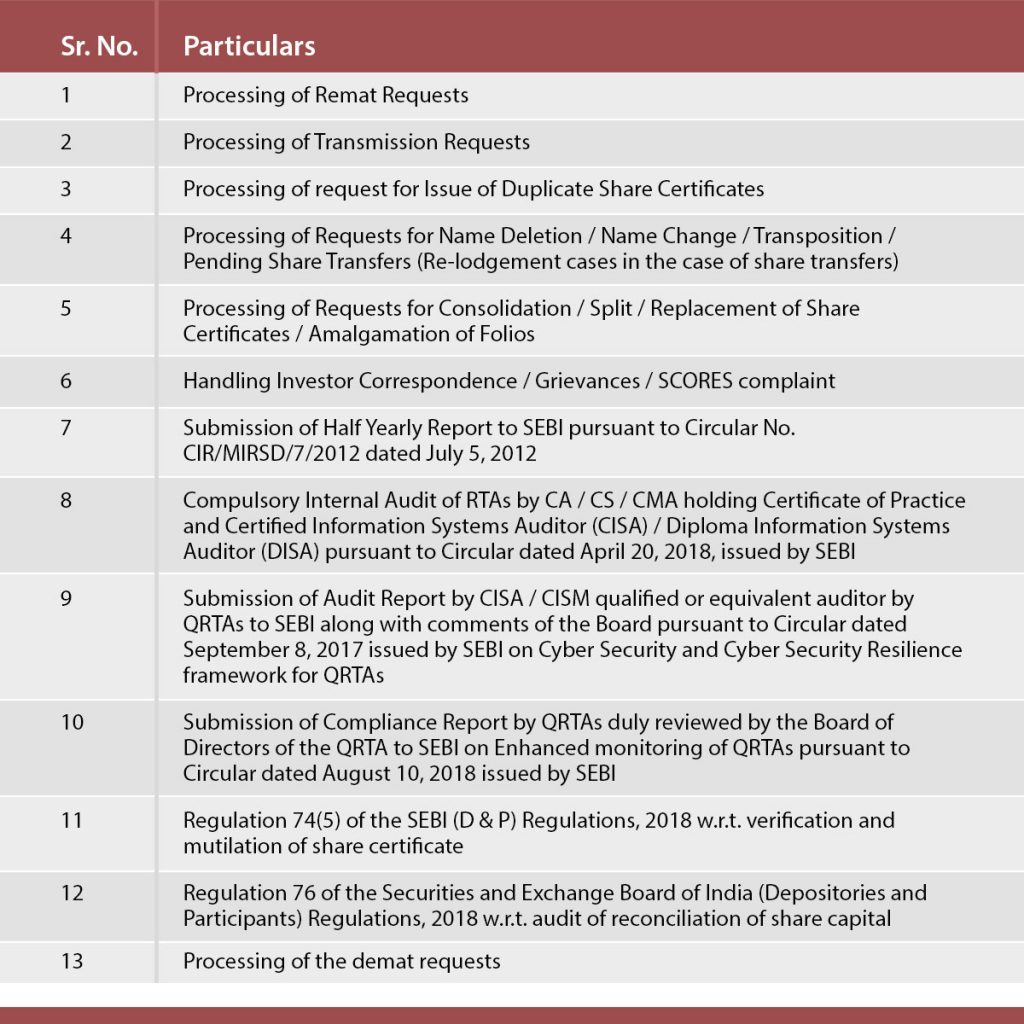

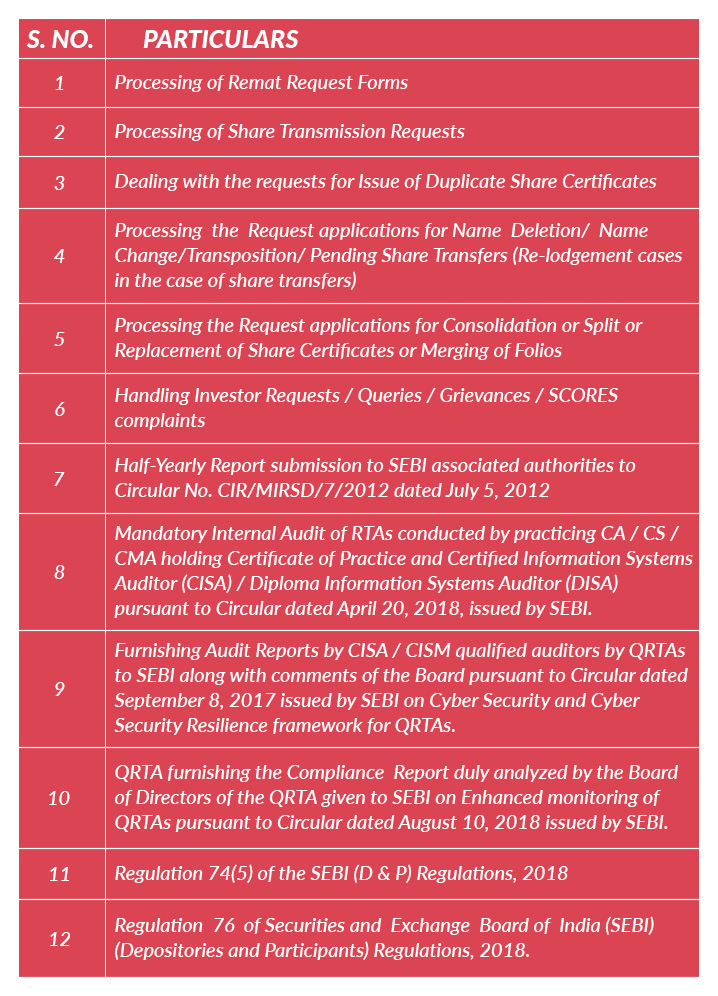

- The relief in the mentioned duration was provided for the listed 12 items in Annexure to the aforementioned Circular. It is declared to add the processing of the Demat requests to this list and as per the list of 13 items which is liable for relaxation stand amended as given:

- Considering the covid-19 situation the relaxation is provided to the intermediaries/market participants towards the compliance through the subject timelines which has been prolonged to 31/07/2021. Towards item no 1-13, the provided relaxation is liable.

- Moreover, a half-yearly Internal Audit Report (IAR) is to be supplied through RTAs in 45 days from the closure of the half-year as it is made compulsory through NSDL Circular No. NSDL/CIR/II/19/2016 on November 7, 2016, and CDSL Circular No. CDSL/AUDIT/RTA/1205 dated July 12, 2016; it has now been decided that 15 May 2021 is the timeline for submission of IAR through Registrar and Transfer Agent towards half-year ended March 31, 2021, has been extended to July 31, 2021 as per the condition of Covid-19.

- In practising the powers under Section 11 (1) of the Securities and Exchange Board of India Act, 1992, the circular is provided to save the interest of investors in securities and to promote the development of, along with regulating the securities market.

- The contents of this circular as well as the circular of 13/04/2020 will be proposed by the stock exchanges and depositories to notice all their corresponding constitutes.

The list of Compliance Reliefs introduced under SEBI Regulations 2015 (Listing Obligations and Disclosure Requirements) amid COVID-19 crises in India

Reference:- SEBI vide Circular No. SEBI/HO/MIRSD/DOP/CIR/P/2020/62 dated 16th April, 2020.

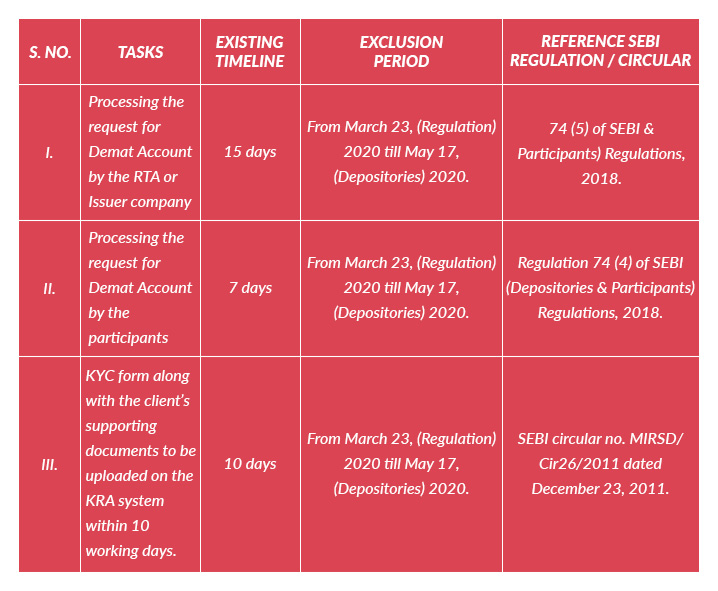

- On account of prevailing COVID-19 crises in India also resulting in extended lockdown, representations are received from the depositories related to the compliance relief on a provisional basis for the following activities performed by depository participants, stockbrokers, share transfer agents/issuers. Following are the compliance reliefs (extended time limit) granted by the authorities:

- As per the aforesaid information, the time period starting from 23 March 2020 to 17 May 2020 shall be excluded for computing the existing timelines specified in Regulation 74 (4) and 74 (5) of SEBI (Depositories & Participants) Regulations, and above mentioned circular dated 23 Dec 2011. Apart from that, all the SEBI registered intermediaries will get 15 days time period to clear all their previous logs.

- All the stock exchanges and depositories are requested to bring into the notice of their members/participants the said provisions of the circular. Also, upload the same on their official websites.

- The circular issued is related to the powers mentioned under section 11(1) of the Securities and Exchange Board of India Act, 1992 and Section 19 of the Depositories Act, that is aimed at safeguarding the interest of the investors in securities and to contribute to the progress and regularity of the security markets.

Read Also:- Why is RTA Important For Both Investors & Fund House?

Relief granted by SEBI (related to the earlier prescribed timelines) looking at the situation caused by COVID-19 in India

Reference:- SEBI/HO/MIRSD/RTAMB/CIR/P/2020/59 dated 13.04.2020

Paying heed to the current scenario of the country – the nationwide lockdown, SEBI has issued guidelines for Registrars to an Issue and Share Transfer Agents (RTA) / Issuer Companies (registered under SEBI) Category 1 and Category 2 of RTI/STA related to the need for extending the timeline for processing several investor requests for physical securities, compliance and disclosures as per SEBI regulations and Circulars.

SEBI has decided to extend the Due Date mentioned in Depository Regulations and other compliance and regulatory norms:-

Relaxations granted by the SEBI are related to:-

- The Certificate acquired from Registrar under the norms of Regulation 74(5) of the SEBI (D & P) Regulations, 2018.

- The reconciliation of Shares and Capital Audit: under the norms of Regulation 76 of the SEBI (Depositories and Participants) Regulations, 2018.

Relaxations given by SEBI related to Circular No. SEBI/HO/MIRSD/RTAMB/CIR/P/2020/59 dated April 13, 2020 states that:

- On account of 21 days nationwide lockdown announced by the government due to COVID-19 crises in India, there is a need to extend the timelines for various compliances including the processing of investor requests related to physical securities and Compliance and disclosures to be made under SEBI Regulations and various SEBI circulars. Such guidelines issued by SEBI are for the Registrars to an Issue and Share Transfer Agent/Issuer Company (registered under SEBI) Category 1 or 2 of RTI or STA.

Extensions in timelines granted by SEBI due to COVID-19 crises

- Paying heed to the COVID-19 outbreak in India and unavailability of the workforce in RTAs / Issuing companies, relaxation is hereby extended to the intermediaries/market participants in the form of extension in compliance for the period equal to the lockdown span (i,e, 21 days starting from 24 March 2020) declared by the Government of India related to the operations like investor requests/compliance as per the annexure.

- Looking at the further extension of the lockdown span (recently announced by the Government of India and State Governments as well), the additional relief has been allotted related to the timelines the same for the number of days equal to the lockdown for all the SEBI registered intermediaries and market participants.

Relaxation has been given for the following Compliances:–

Relaxation from compliance with certain provisions of the SEBI Regulations, 2015 Due to the COVID -19 Virus Pandemic

The world is fighting against CoVID 19 virus Outbreak, which is impacting industries, financial structures, and human life in a very bad way. In between it, SEBI on Mar 19, 2020, released a circular with No.: SEBI/HO/CFD/CMD1/CIR/P/2020/38 in the subject of Relaxation from compliance with some specific provisions of the SEBI (Disclosure Requirements and Listing Obligations) Regulations, 2015 due to the CoVID -19 virus pandemic. The circular is focused on all listed entities that have listed their specified securities, all Recognized Stock Exchanges, and all Depositories. The circular provides the due dates, extended dates and also relaxation for Regulation and associated filing. Check the circular below.

Facilitating transaction in Mutual Fund schemes through the Stock Exchange Infrastructure

Read Also:- SEBI’s Latest Notifications Mandate Shares and Securities in Demat Form

SEBI which stands for Securities and Exchange Board of India released a circular (SEBI/ HO/MRD1/DSAP/CIR/P/2020/29) on Feb 26, 2020, in the matter of Facilitating transaction in Mutual Fund schemes through the Stock Exchange Infrastructure. The circular is important to all recognized Stock Exchanges, Clearing Corporations and Depositories (except Stock Exchanges and Clearing Corporations in International Financial Services Centre). This circular mentioned two other circulars that were released in 2013-2014 and permitted mutual fund distributors to use recognized stock exchanges’ infrastructure to purchase and redeem mutual fund units directly from Mutual Fund or Asset Management Companies. The complete circular is given below.

A circular was issued by the Security Exchange Board of India (SEBI) on January 22, 2020, to all the recognized Stock Exchanges, Registered Stock Brokers, Depositors, Registered Merchant Bankers, Registered Depository Participants, Registered Registrars to an Issue & Share Transfer Agents and Registered Bankers to an Issue.

With the circular, SEBI has streamlined the procedure of the rights issue and the due consideration is given to the Dematerialization of shareholders’ Rights Entitlements (REs).

The circular signifies the efforts taken by the Security Exchange Board of India (SEBI) to ease the process of a rights issue. Besides, the SEBI has emphasized on the Demat account for all the Right entitlements (REs) to improve the efficiency and effectiveness.

Read Also:- Complete Process to Register With SEBI For The RTAs