The Ministry of Corporate Affairs has introduced a new form, i.e. Form PAS-6 (Reconciliation of Share Capital Audit Report on a half-yearly basis), which is basically used for the reconciliation of the share capital audit report on a half-year basis.

Form PAS-6 is introduced in pursuance of the sub-rule (8) of rule 9A of the Companies (Prospectus and Allotment of Securities) Rules, 2014, which was amended vide Companies (Prospectus and Allotment of Securities) Third Amendment Rules, 2019.

Let us get to know in detail about Rule 9A of the Companies (Prospectus and Allotment of Securities) Third Amendment Rules, 2019. The rule states that:

Every Unlisted Public Company shall-

- Issue the securities only in demat form.

- Convert it’s all its existing physical securities into demat according to the provisions of the Depositories Act,1996 and Regulations made thereunder.

- demat of all its existing securities by making the necessary application to a depository.

- shall secure an ISIN for each type of security.

- shall inform all its existing security holders about such a facility.

Every Unlisted Public Company before making-►

- Issue of securities, or

- Buyback of any securities, or

- Bonus Issue, or

- Right Issue,

has to convert the entire securities of its Promoters, Directors, and KMP into dematerialized form.

Every holder of securities of an Unlisted Company-

- Who wants to transfer such securities on or after 2nd October 2018.

- Who wants to subscribe to any securities of an unlisted public company on or after 2nd October 2018.

shall ensure that all his existing securities are held in dematerialized form before such a subscription.

Dedicated SAG RTA Team to Handle Client Transactions and Queries

Appoint SAG RTA as Your RTA Service Provider Now

Appoint RTA Agent NowEvery Unlisted Public Company shall also Ensure that –

- It makes timely payment of fees (admission as well as annual) to the depository and Registrar & Transfer Agent according to the agreement executed between the parties.

- It maintains security deposit, at all times, of not less than two years’ fees with the depository, in such form as may be agreed between the parties.

- Complies with the regulations or directions or guidelines, circulars, if any, issued by the SEBI or Depository from time to time, considering the dematerialisation of shares of unlisted public companies.

No unlisted public company that has defaulted in sub-rule (5) shall make-

- Issue of securities, or

- Buyback of any securities, or

- Bonus Issue, or

- Right Issue

till the payments to the depositories or the Registrar and Share Transfer Agent are made.

The Reconciliation of Share Capital Audit Report (in form PAS-6) provided under sub-rule (8) and (8A) of rule 9A Companies (Prospectus and Allotment of Securities Rules, 2014, shall be submitted by the unlisted public company on a half-yearly basis to the Registrar under whose jurisdiction the registered office of the company is situated within sixty days from the conclusion of each half-year duly certified by a company secretary in practice or chartered accountant in practice.

The company shall also immediately bring to the notice of the depositories any difference observed in its issued capital and the capital held in dematerialized form.

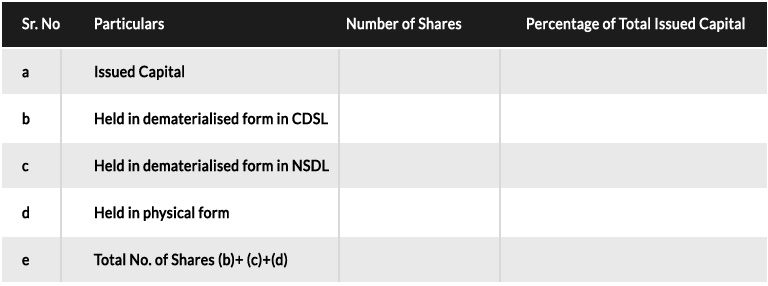

Key Details to be inserted within the Form PAS-6:

- Securities ISIN (International Securities Identification Number)

- Period of Return Filing

- Company capital details as per the format

Difference with reason if there is any in the points (a) and (e),

Changes in share capital, if any, in the six months for any given issue;

- Right Issue,

- Bonus Issue,

- Private Placement,

- ESOPs,

- Amalgamation,

- Conversion,

- Buy back,

- Capital Reduction,

- Forfeiture,

- any other.

*It is to be noted that the share numbers and the relevant facts must be conveyed to the NSDL/CDSL must be included in Form PAS-6.

- Complete details of the shares held by the Promoters, Directors and KMP in physical or dematerialized form.

- Details regarding the register of members updation.

- Details of dematerialized shares in excess in the previous half-yearly period, with the reason.

- Total number of dematerialization request details if they are pending for more than 21 days, with the reason for the delay.

- Company secretary details of the company (If any).

- Details of practising professionals certifying the form.

- Details the appointment of a common agency for share registry work.

It is to be noted that all the required details must be furnished within 60 days from the half-year ending on 30th September and the 31st March of every financial year concerned with the individual ISIN.

Role of SAG RTA (Registrar & Share Transfer Agent):

The Registrar is an Issuer’s agent as the Issuer is the Company that opts for dematerialization and acts as an intermediary between the Issuer and the depository for facilitating multiple RTA Services like Dematerialisation, Rematerialisation, Initial Public Offers (IPOs), and Corporate Actions such as (Right Issue, Bonus Issue, Private Placement, Buyback, etc).

In order for Companies to be able to issue securities or shares in dematerialized form, they must appoint a SEBI-approved Registrar and Transfer Agent that has direct/online access to depositories. The RTA acts as a direct point of contact between the security Issuer and depositories and manages the transactions of users with the depositories.

By the recent aforesaid changes in the statutes, the government has mandated the appointment of an RTA for every company. The company has to appoint the Registrar & Share Transfer Agent and requires them to get their securities to be dematerialized. It has become a compulsory process for unlisted Public Companies to avoid non-compliance.