If a person wants to open his or her own business or wants to expand the business but does not have enough money to do so. Then the person has only two options i.e. to take a loan from the bank or to divide the finance cost into a unit and then sell it as share in the financial market. The company will buy the shares by which the funds will be raised and will help the person for the startup or the expansion of the business.

So for this it is very important to know about shares and its types.

What is a Share?

A share is a sole unit of the ownership in a company. This is an exchangeable value of a company which goes up and down based on the different market factors. The capital is divided into the shares for raising the capitals. Shares are aka stocks.

Shares can be divided into two types:

1) Equity Shares

2) Preference Shares.

1. Equity Shares:

Equity shares also called as ordinary shares are the form of part or fractional ownership in which the shareholder has to take the business risk at the extreme. The Equity shares are holded by the company members who have the rights to vote. In a company, Equity shares play a very important role in raising long-term capital.

Ownership of a company is represented by the Equity shares and the capitals that are raised by the issue of such shares is called the ownership capital or the owner’s fund. They are the person who created the company.

The Equity shareholders receive the company’s profit in dividend form which is not fixed because there is a fluctuation in it as per the profit. It means that if there is more profit then they will receive more dividend and vice versa.

Classifications of Equity Shares:

- Authorized Share Capital

- Issued Share Capital

- Subscribed Share Capital

- Paid Up Capital

Recommended: What are the Key Differences Between Dematerialisation and Rematerialisation

2. Preference Shares:

Preference shares are the shares which give the company holders a fixed dividend, whose payment is more prior than the equity share dividends. Capital raised by the issue of preference shares is known as the preference share capital. The preference shareholders do not have any rights to control the event of the firm. In the event of the bankruptcy of the company, the preferred shareholders are paid before the company’s property.

Types of Preference Shares:

- Cumulative Preference Shares

- Non- Cumulative Preference Shares

- Redeemable Preference Shares

- Non-Redeemable Preference Shares

- Convertible Shares

- Non-Convertible Shares

- Participating Shares

- Non-Participating Preference Shares

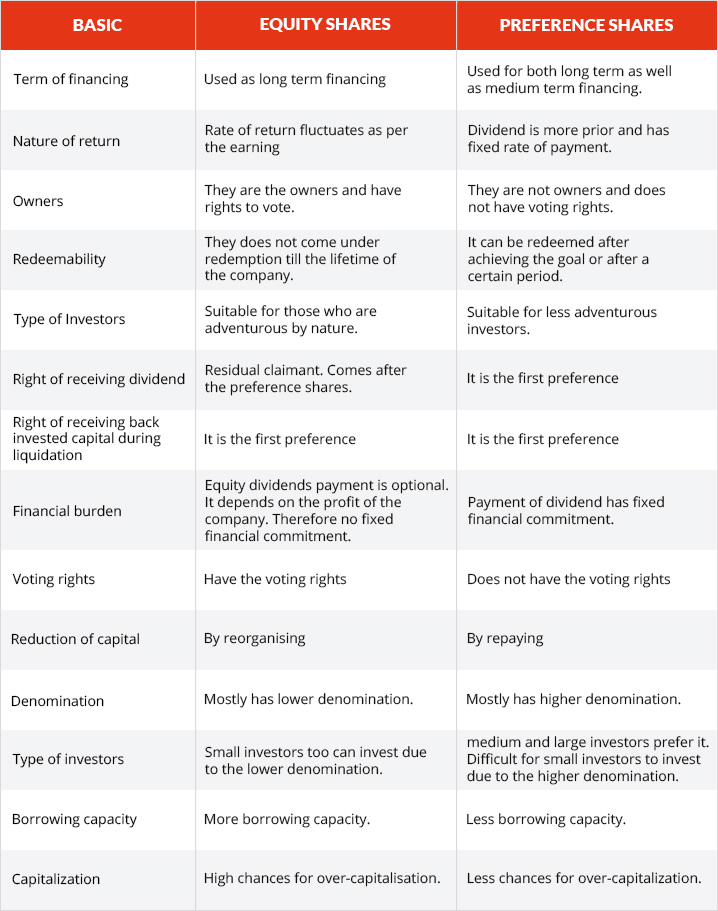

Difference Between the Equity and the Preference Shares:

Given below are the differences between the equity shares and preference shares: