As you have heard that, Shares Dematerialization is necessary for share transfer any activity in relation to the shares of unlisted companies, listed companies, and soon-to-be-notified private companies, thus it becomes more imperative to know about dematerialization, rematerialization, Demat and Remat.

If you are interested or already a part of the share market then you probably know about these terms but if you don’t know about them, or want more info then this article has everything you want.

Previously, Share Certificates were issued in physical form only, In this way, the investors had great difficulty in keeping them safe. There are always some risks such as physical damage, forgery of shares, and theft. Share certificates also had to be sent through postal mediums which took a lot of time.

Read Also: Demat Account – What it is And How To Open A Demat Account Online

But now, to make the complete procedure hassle-free the government introduced the dematerialization process. It is a process by which the physical shares are converted into electronic form and can be stored in the demat account via the system of the depositories i.e. NSDL or CDSL. To trade in the share market the first thing you have to do is Contact with SEBI registered stockbroker and open a Demat and trading account. These broking houses can be divided into two types, which are listed below.

Types of SEBI Registered Stockbroker

Discount Brokers:- Discount broker allows clients to buy and sell securities but it does not provide advice, research, planning, or other investment services.

Full-Service Brokers:- They provide all the guidance, research, planning, support, and other required investment services. So if you are a beginner in the field of the share market then you should go to the Full-Service Brokers.

Read Also: Complete Procedure For Dematerialisation Of Shares Under RTA

Dematerialization

It is the process by which physical share certificates of an investor are taken back by the company or registrar & share transfer agent and then they destroy it. The equivalent number of securities in the electronic form is then credited to the investor’s account with his Depository Participant.

Basically Dematerialization process converts physical share into electronic format. The owner of these shares has to open a Demat and trading account with SEBI registered stockbroker to keep the dematerialized shares or to trade them in the share market.

Procedure for Dematerialisation:

- First of all, you need a Demat account for dematerialization of shares. A Depository Participant/Stockbroker can help you in that.

- After owning the account, get the Dematerialisation Request Form or DRF and fill it.

- Then submit the filled DRF alongwith the physical share certificates to the Depository Participant/Stockbroker.

- Depository Participant or Stockbroker will then send your request to the Depository and Registrar and Share Transfer Agent.

- The registrar will then complete the dematerialization and then it will inform DP about it.

- Upon approval by Registrar, All the Electronic Shares will be credited to your Demat account.

Read Also: Know The Advantages of Dematerialisation

Rematerialization

Actually, rematerialization is a process to convert electronic shares into physical shares. So actually it is just the opposite of dematerialization. It is beneficial for those shareholders or investors who only have 1 or 2 shares and want to avoid annual maintenance charges of Demat account, just to hold those 1 or 2 shares.

Procedure for Rematerialisation:

- Get the Rematerialisation Request Form (RRF).

- Fill it carefully and submit it to Depository Participant/Stockbroker.

- Then they will send the request to the Registrar and Share Transfer Agent.

- RTA (Registrar and Transfer Agent) makes physical certificates and then sends it to the shareholder/ investor.

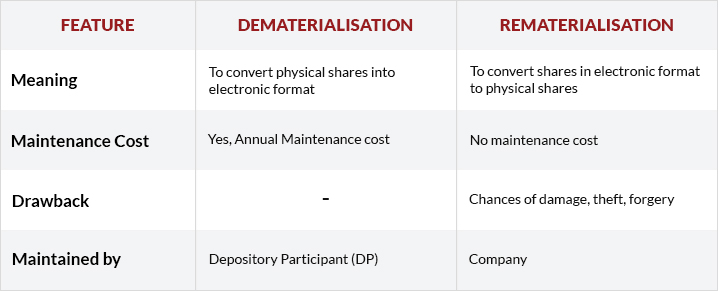

Dematerialization v/s Rematerialization

Read Also: Complete Procedure For Dematerialisation Of Shares Under RTA

An Investor needs to know all the differences and benefits of Dematerialization and Rematerialization. For selling and buying the shares in electronic format are better. It also makes the transaction process hassle-free and quick.

For avoiding annual maintenance charges on merely 1-2 shares the Rematerialization process is present. We hope through this article you will get a pixel-perfect idea of which process is beneficial for you. It also clears doubt about the difference between Remat and Demat. If you have any query feel free to use the comment section we will respond to your query as soon as possible.