As per the Company Act 2013, the companies in India can raise funds via different methods, which include preferential allotment, right issue, IPOs, employee stock option plan (ESOP), and sweat equity shares. Among all the prescribed methods, the preferential allotment is considered to be the best fundraising option for unlisted companies.

The procedure and provisions of preferential allotment of shares are mentioned under Section 62 (focuses on allotment of shares) and Second 42 (focuses on allotment of securities) of the Companies Act 2013.

Let’s Try to Understand What Exactly is Preferential Allotment of Shares, Its Benefits, and Why It is Done:

What is Preferential Allotment of Shares?

Preferential allotment of shares refers to the procedure of bulk allotment of fresh shares to a specific group of individuals, venture capitalists, companies, or any other person by any particular company. This process is termed as the preferential allotment of shares.

This method is certainly unique from other fundraising methods as the entire allotment is made to a pre-identified people, who may or may not be the existing shareholders of a firm. These are generally the individuals, who are interested in getting a stake in the company.

Why Companies Exercise this Option?

Preferential allotment of shares option is mainly used by the companies to provide a route to those shareholders, who are unable to buy a large chunk of company shares at affordable prices during IPOs. However, such shareholders do no get any voting position in the company and are paid only when the company made profits.

Apart from this, the venture capitalists, financial institutions, and existing shareholders or company promoters are also given an option to increase their stakes in the company by the firm owners through exercising the preferential share allotment option. The companies also use this option to secure the equity participation of those shareholders, whom they believe can be of value as shareholders.

Lastly, there is a high possibility that companies performance will improve after exercising preferential share allotment option if funds were raised in an efficient manner as well as veteran investors have invested in them. The veteran investors trust in any company during the preferential share allotment can drive the growth of its business in the near future.

Read More: Complete Procedure For Right Issue of Shares Under Companies Act: 2013

What are the Benefits for Preference Shareholders?

- In the case of preferential allotment of shares, the preference shareholders are directly paid by the company with zero brokerage cost.

- Preferential shareholders can claim for dividend in the subsequent year if they are not offered with the same for any given particular year.

- Preference shareholders capital is always safe even if the company fails in the market or gets bankrupt; the preferential shareholders are paid first among all.

However, as discussed, the only major drawback that preferential shareholders face in their inability to get voting rights in the company.

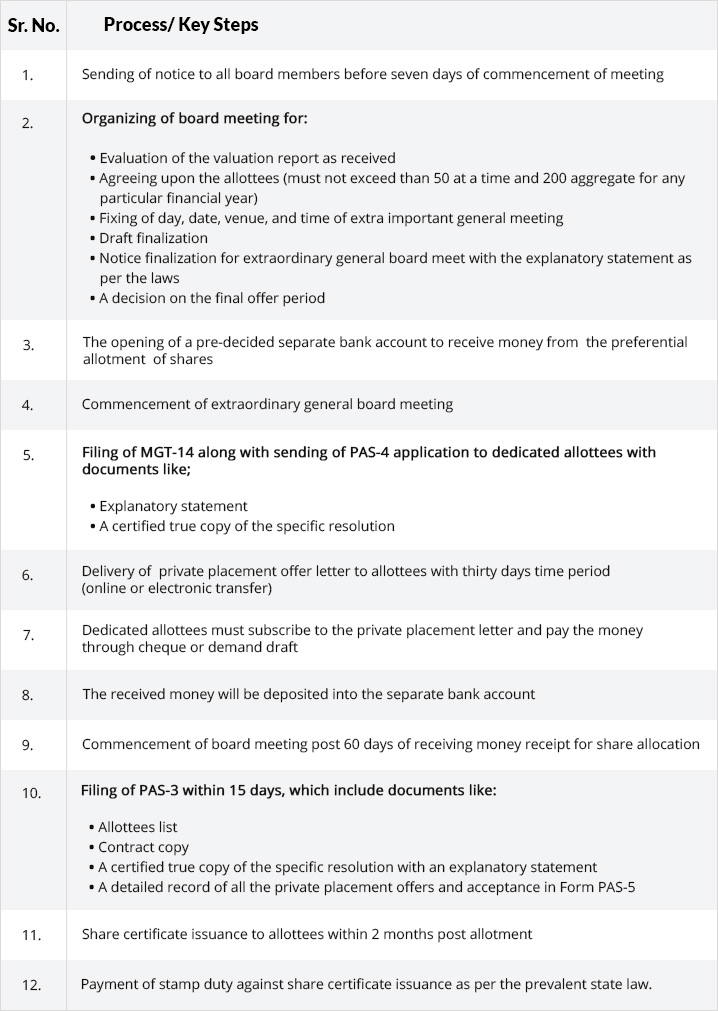

What is the Procedure for Preferential Allotment of Shares?

For preferential allotment of shares, a special resolution is required to be passed among the existing shareholders with 75% of them voting in favour of it. The number of shares issued, their pricing, and preferred companies or individuals is also decided as per the preference of existing shareholders upfront.

Dedicated SAG RTA Team to Handle Client Transactions and Queries

Appoint SAG RTA as Your RTA Service Provider Now

Appoint RTA Agent NowThe Detailed Procedure for Preferential Allotment of Shares is Given Below in the Table: