The NSDL has provided the uidelines for removing deceased holders’ names from joint demat accounts. Surviving holders must submit a specific request with the death certificate within a year of demise. If not, a new account will be opened.

The guidelines detail the process for account holder succession, address updates, and verification procedures. The circular also introduces a screen-based deletion option in the NSDL system by October 31, 2023. Participants must adhere to these guidelines and communicate updates to their clients.

In a recent circular notification, the National Securities Depository Limited (NSDL) has provided operational guidelines for the transmission of securities in joint demat accounts through the deletion of names.

The notification is referencing NSDL circular nos. NSDL/POLICY/2022/025 dated February 28, 2022, concerning modifications to Bye Laws and Business Rules, and NSDL/POLICY/2022/053 dated April 08, 2022, concerning Operational guidelines regarding Mode of Operation.

It informs participants that the necessary changes in the NSDL system about the deletion of names of deceased account holders in joint demat accounts will be communicated separately.

The Following Operational Guidelines Have Been Outlined for the Deletion of Names in Joint Demat Accounts:

- In case of the death of holder(s), in the Joint Demat Account, the surviving holder(s) may continue the existing Demat account by submitting a specific request (Illustrative format is enclosed as Annexure (I)). The request should be accompanied by the original death certificate or a copy of the death certificate attested by the joint account holder(s).

Along with that, the verification of the death certificate can be done with the original copy or a copy attested by a notary public, a gazetted officer, or a downloaded death certificate from the online portal of the government with a digital or facsimile signature of the issuing authority.

- If the surviving holder(s) fails to submit the request above within one year from the date of demise, a new demat account will be opened as per the existing procedure for executing transmission.

3. In case the first holder of the demat account is deceased:

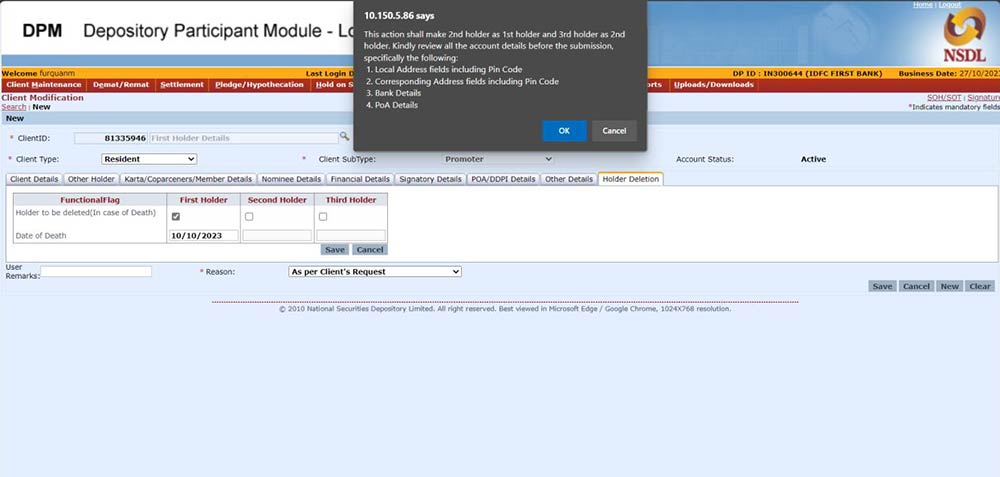

- If the first holder is deceased in the demat account, the second holder will become the first holder, and the third holder (if any) will become the second holder.

- Participants are advised to review and update the details of the second holder, such as name, father’s/spouse’s name, PAN, mobile number, email ID, date of birth, family flag, SMS flag, PAN flag, etc.

- Participants should also update the local address, correspondence address, bank account details, signatory details, POA/DDPI details, etc., in the first holder’s details.

- The login details of the first holders for IDeAS/SPEED-e will be deleted or deactivated, and the next first holder will receive an email from NSDL to register the IDeAS/SPEED-e facility.

4. In case the second holder in the demat account is deceased:

- If the second holder is deceased in the demat account, the available details of the second holder will be deleted.

- In the case of a joint demat account with three holders, the deletion of the second holder’s name will promote the third holder to the position of the second holder.

- Participants are advised to review and update the details of the third holder, including name, father’s/spouse’s name, PAN, mobile number, email ID, date of birth, family flag, SMS flag, PAN flag, etc.

- The first holder’s details will remain unchanged.

5. If case the third holder in the demat account is deceased:

- In the event of the death of the third holder in the demat account, there will be no changes to the details of the first and second holders.

- The available details of the third holder will be deleted.

6. The above guidelines apply to individual client demat accounts without pledged securities or on-hold securities.

7. If the demat account has any pending requests, such as demat/ remat/ conversion/ re-conversion/ re-purchase/ tender offer, participants should process the requests for deletion of names. However, the monitoring of such pending requests, if any, will be the responsibility of the surviving client(s).

8. Participants are required to verify the submitted documents and the signatures of the surviving client(s) before effecting the deletion of names.

9. Participants are advised to send intimation to clients via letter, email, or any other suitable mode after the deletion of names in demat accounts.

In light of the provided guidelines, a screen-based option for the deletion of names in the National Securities Depository Limited system will be made available and released at the end of the day (EOD) of October 31, 2023.

Participants are Urged to Take Note of the Circular Notification and Inform Their Clients Accordingly.

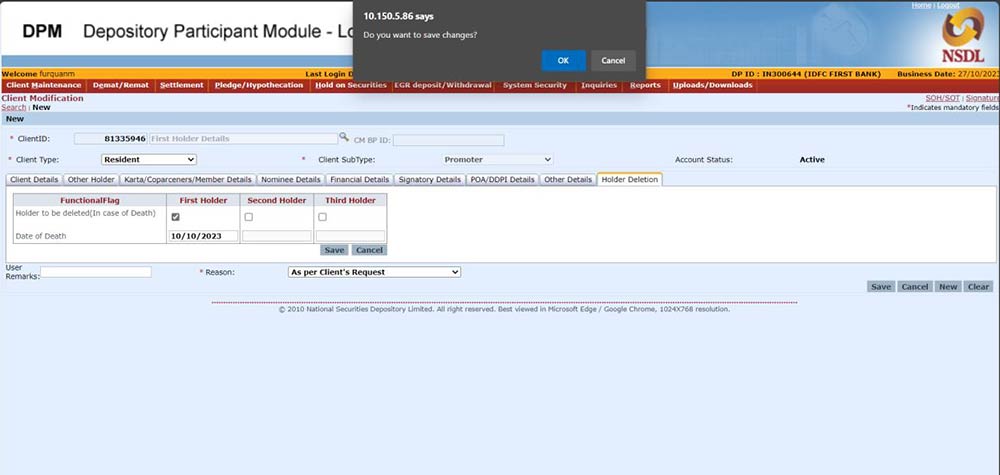

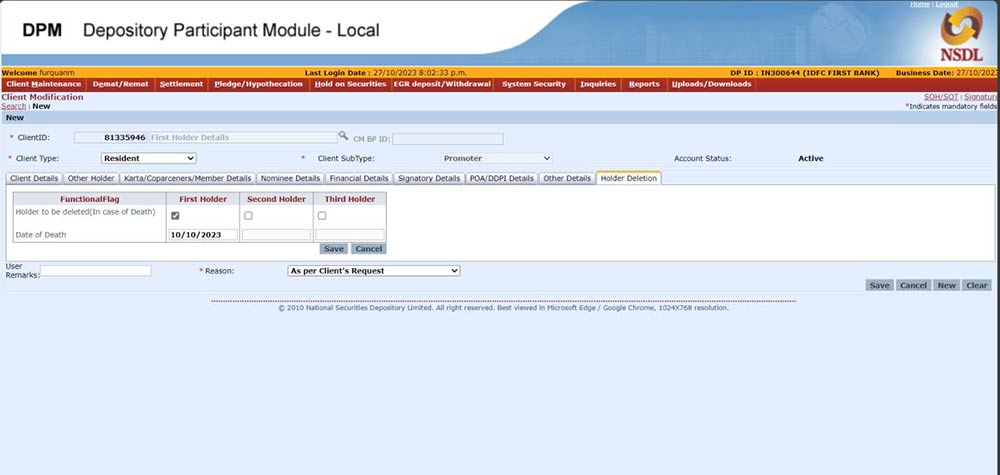

The NSDL circular highlights crucial steps for client modification, including screenshots of Annexure I and Annexure II. Annexure II provides a detailed view of screens and steps for individual category client modifications stated below-

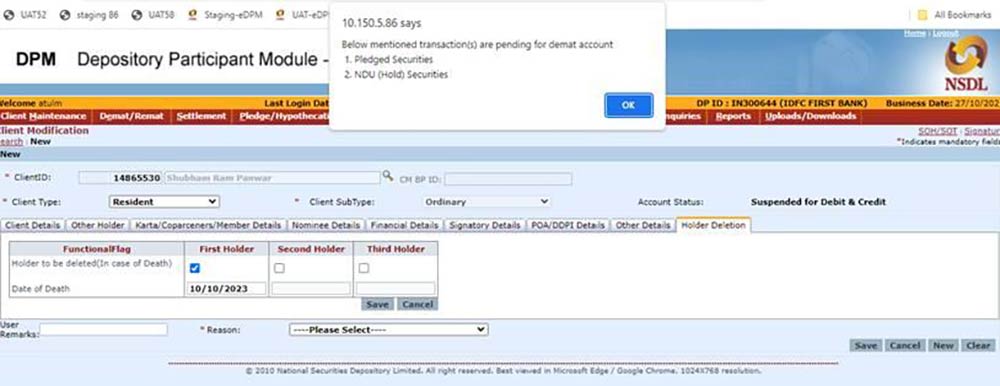

1. For holder deletion, participants must navigate to the Holder Deletion tab, selecting the holder(s) for ‘deletion of name.’ Deceased holder(s)’ date of death must be recorded in the system.

2. If the client’s demat account has open pledges or on-hold securities, the system restricts the deletion of the deceased holder’s name. In such instances, adhere to the existing transmission procedure.

3. Participants are instructed to update details like local address, correspondence address, bank account information, signatory details, POA/DDPI details, etc., in the first holder’s information. If the first holder is deceased, carefully review all details before submitting modification requests.