On March 5, 2021, the MCA (Ministry of Corporate Affairs) issued a Notification via Companies (Management and Administration) Amendment Rules, 2021, Chapter VII of the Companies Act, 2013. The aforesaid rules shall be effective from March 05, 2021, i.e. the same date.

In this notification, Rule 11 has been amended i.e. Annual Return in rule 11 sub-rule 1 has been substituted:

New Amendments

Every company shall have to file its annual return in Form No. MGT-7 except

- One Person Company (OPC) and

- Small Company

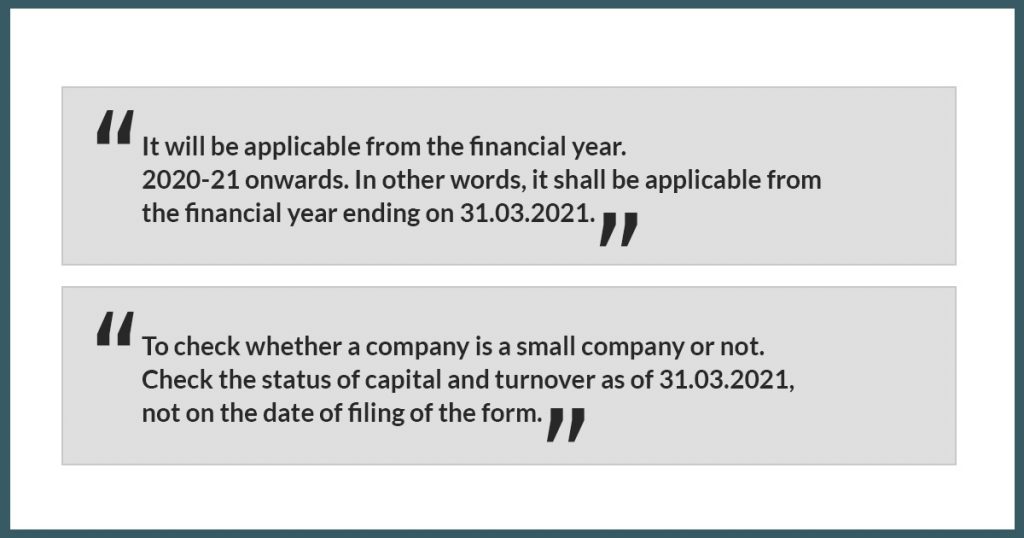

*One Person Company and Small Company (both) shall file annual returns from the financial year 2020-2021 onwards and that to in Form No. MGT-7A.

One Person Company:- As per Section 2(62) “One Person Company” connotes a company that has only one person as a member of the entire company.

Small Company:- As per Section 2(85) of the Companies Act 2013, a “small company” can be defined as a company, other than a public company whose.

- paid-up share capital does not exceed Rs 50 lakhs or such higher amount as may be prescribed which shall not be more than 10 crore rupees];

- turnover of which as disclosed by the profit and loss account for the immediately preceding financial year does not exceed Rs 2 crores or such higher amount as may be prescribed which shall not be more than Rs 100 crore :

Excepting That Nothing in This Clause Shall Apply To—

(A) a holding company or a subsidiary company;

(B) a company or body corporate governed by any special Act or

(C)a company registered under section 8;

- First Amendment:- Amendment in MGT-7 required to be filed for Companies except for Small Company and One Person Company.

Point inserted in MGT-7*

- ISIN of equity shares of the Company

- Date of listing with details

- CIN & Name of Registrar and Share Transfer Agent,

- Details of the stock exchange where Share are listed,

- Indebtedness has been removed from MGT-7 (as the same has been covered in the financial statement)

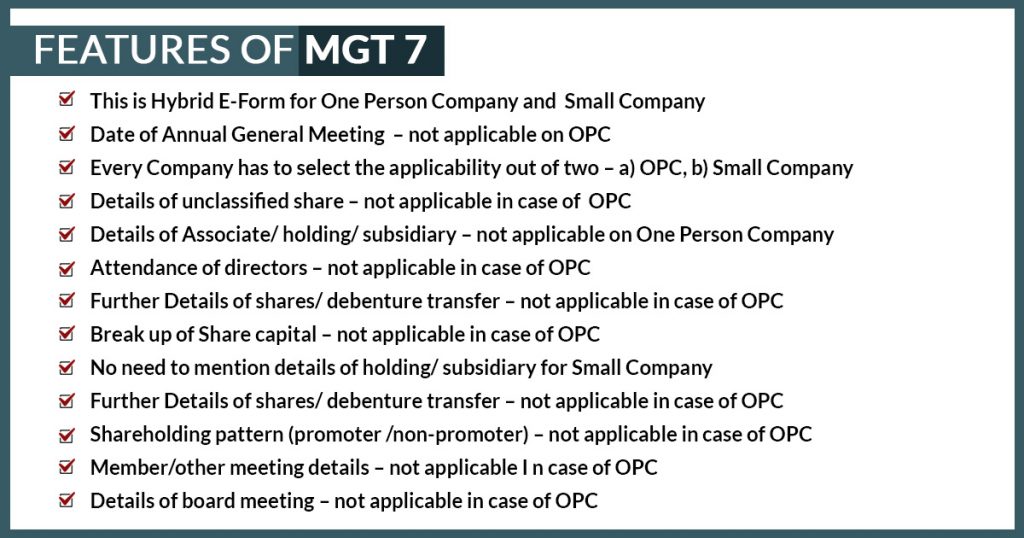

- Second Amendment:- About e-form MGT-7A that is required to be filed for Small Company and One Person Company.

Note:

Features of MGT-7A

Here we are some Important Message For Companies

Every company whether public limited or “private limited” excluding One person company (OPC) and Small company shall file MGT-7 that will insert the details of the Registrar & Share Transfer Agent and ISIN of the equity shares of the company. Thus it shall need to furnish the MGT-7 with the details of RTA.

SAG RTA is a SEBI registered Registrar and Transfer Agent and also a committed company to make things easier, We offer complete services of RTA such as dematerialization of shares, back office, data management, and more. Check out more here.

Note:- Private Companies who already have opted ISIN (International Securities Identification Number)