The transmission of shares refers to the process of devolution of the title (ownership) to shares either due to the death of the holder or because of succession or inheritance. In any case, if you wish to file a request for transmission of shares from a deceased owner to a legal heir, this is the affidavit you need to file and submit with the Registrar and Transfer agent.

The applicant may be required to make some declarations and provide adequate proofs in support of his/her claim.

Important Notes:

- The Affidavit must be submitted on a Non-judicial stamp paper of Rs. 100/-, or should be duly attested and affirmed by Notary.

- Please do not just type this format as it is. Kindly provide the details as per the documents you are attaching.

- This Declaration can only be filed by the legal heirs who must provide a self-attested copy of the PAN card as identity proof.

- A Maximum of three legal heirs can apply for transmission.

How to File?

The affidavit form includes the following sections:

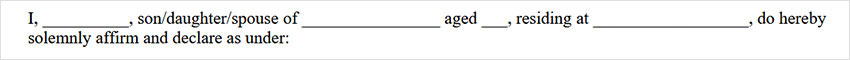

Provide your name, shareholder’s name, age, your current address and other details with the declaration.

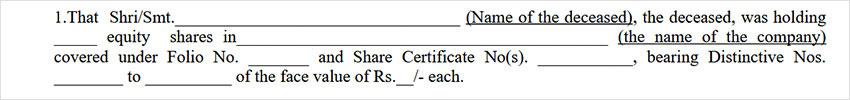

1. Details of The Deceased, Folio, etc.

Enter shareholder’s name along with share and folio details, including the company name, folio no., share certificate no., face value, etc.

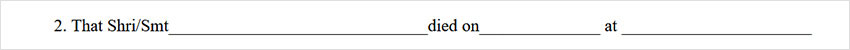

2. Confirmation of Shareholder’s Death

Provide the time and date of the death of the shareholder.

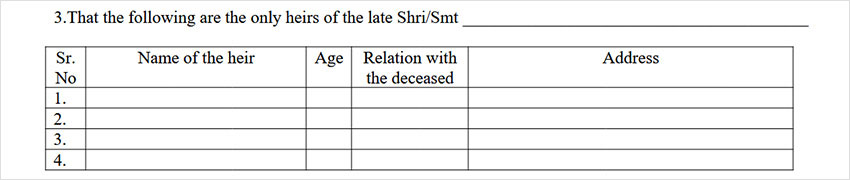

3. Details of Heirs

Provide details of all the legal heirs of the deceased (shareholder), including their names, age, relationship with the person, and addresses.

4. Confirmation of Ownership

By reading this, you are declaring that the said shares were solely and completely owned by the deceased.

5. Confirmation of Succession

You declare that the heirs mentioned in clause 3 are legally entitled to inherit the said shares of the deceased.

6. Declaration of Exclusivity

Hereby you confirm that the person/s mentioned in clause 3 are the only living, legal heirs of the deceased.

7. Non-producing of Probate /Succession Certificate / Letters Of Administration

Hereby you declare that you, along with other applicants (heirs) if any, have already executed indemnity bond for transmission of the said shares in your name/s with producing Probate of Will /Succession Certificate / Letters of Administration.

8. Request for Transmission

Enter the name of the share (mutual funds) company to whom you are requesting to transmit the shares in your name/s.

Verification of the above-mentioned information by the applicant.