Preference shares are generally given priority over the common or equity shares by the company owners when they made payment of surplus or dividend. Well, those are a bit unfamiliar with the preferential allotment of shares, the preference shareholders are the first ones who get dividends in case the company decides to pay the same. Owners of the preference shares get fixed dividend, Although in a company liquidation event, the preference shareholders are paid after the bond shareholders, but before the equity holders.

To clarify things a bit more, when a particular individual buys shares of any specific company, he/she becomes part-owner of the same firm. Therefore, the person is known as a common shareholder or equity shareholder. But, one cannot directly become a preference shareholder as they are generally the people who own the capability to buy a large chunk of company shares and such shareholders are also pre-decided by the board members by passing a special resolution.

The preference shareholders generally include company promoters, large VCs, financial institutions, and board of directors of a company.

Preference shares are also known as the preferred stock or preferred shares and can be any combination of attributes, i.e. features of both equity and debt.

Talking more about preference shares, they can be converted into common stocks in respect to divided and asset payout during liquidation of the company. Preference shares can also be redeemed before the specified maturity period, but as per the discretion of the company. However, these shares are illiquid as they can’t be traded on stock exchanges. The preference shareholders also do not get voting rights in the company.

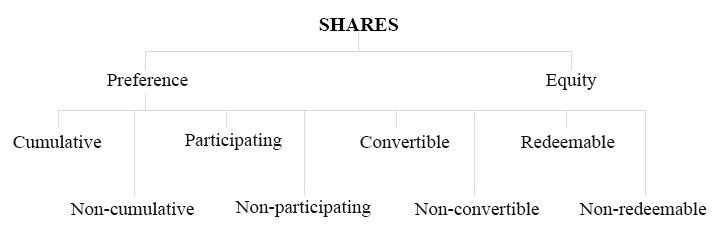

To Give You a Detailed Idea, Different Types of Preference Shares are Mentioned Underneath:

1. Cumulative Preference Shares

Cumulative preference share mainly refers to those shares which have a right of dividend even in those years when a company does not make any significant profits. The companies are bound to pay the unpaid dividend on preference shares before they made any payment of dividends to equity shareholders.

If a company skips paying the dividend on preference shares in a ‘no profit’ year, then such unpaid dividend is called arrear. The arrears accumulate for every subsequent year and must be paid out of profits by the company.

2. Non- Cumulative Preference Shares

It is very evident from the name; the dividends on these shares do not accumulate every subsequent year in case if they are unpaid when due. Non-cumulative shares have reverse characteristics to cumulative shares which also means that dividends on such shares are only paid from the profits made in a given/same year.

If any particular company does not make a satisfactory profit, then non-cumulative preference shareholders get zero or partial dividends whereas arrears do not get carried forward in subsequent years.

3. Redeemable Preference Shares

As per Section 80 of the Companies Act, the preference shares, which can be redeemed or repaid after a specific time period or at the company discretion are generally known as the redeemable preference shares. Such shares are permanent in nature until a specific company goes to the liquidation and in that case, such shares resemble the equity shares.

4. Non-Redeemable Preference Shares

As the name suggests, these shares cannot be redeemed by the shareholders and are also at the option of the company, until it becomes defunct. So, the shareholders, in this case, are strongly advised to find alternative ways of investment for getting an equal amount of sum that he invested in non-redeemable shares. So, investment in equity shares is also more profitable in this particular case.

5. Convertible Shares

Convertible share is the ones which can be easily converted into the equity share at a specific rate that is pinned on the expiry of a stated period. The holder of such shares enjoys the right to convert their shares into equity ones within a specific period.

6. Non-Convertible Shares

One can easily get an idea about the functioning of the non-convertible shares through their name itself. Still, to clarify the odds, non-convertible shares are the ones that cannot be converted to equity ones.

7. Participating Shares

Participating shareholders own the right to participate in surplus profits of the company in case of liquidation along with the other equity shareholders. apart from the fixed deposits, the participating shareholders also have the luxury to participate in surplus profits that are offered only to equity shareholders of the company during its functioning. The surplus profits are divided among the participating preference shareholders and equity shareholders in a pre-agreed ratio.

8. Non-Participating Preference Shares

As the name suggests, the non-participating preference shareholders do not own a right to have payments for the additional surplus made by the company during its functioning and even after it reaches the liquidation stage. In practicality, most of the preference shares are non-participating in nature, which limits the preference shareholders to receive only stated dividends no less and no more.

This is also because preference shareholder leaves the company extra earnings/profits in lieu of their right to receive the stated dividends each year.