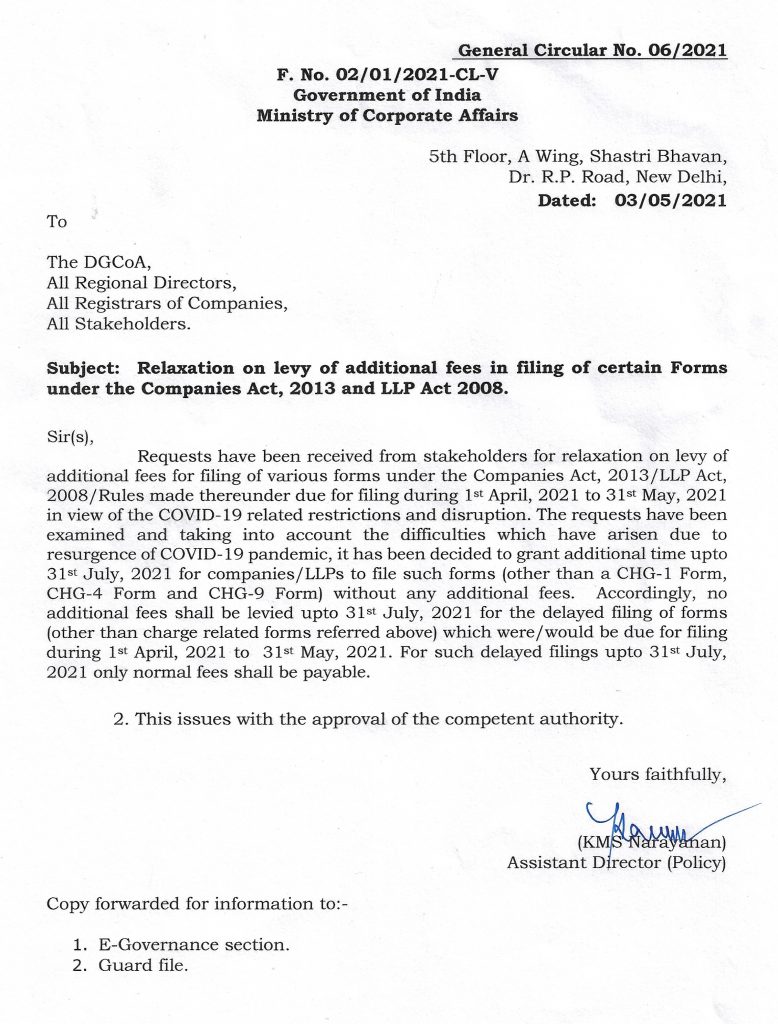

Considering the difficulties that are being faced by the various stakeholders while filing various forms under the Companies Act 2013 and LLP Act, 2008, the Ministry of Corporate Affairs through its circular bearing date May 3, 2021, has extended additional time up to July 3, 2021, for companies /LLPs to file such forms during April 1, 2021, to May 31, 2021, without payment of additional fees.

Consequently, Companies/LLPs can file any form (excepting the below-mentioned forms) Which were or would be due for filing from April 1, 2021, to May 31, 2021, up to July 31, 2021, without any additional fees.

However, The Below-Mentioned Forms are Not Subject to the Above-Mentioned Relaxations:

- CHG-1 i.e. Applying for the registration of creation, varying of charge (other than those related to debentures)

- CHG-4 i.e. Form for filing particulars for the purpose of satisfaction of charge just mentioned

- CHG-9 i.e. Applying for the registration of creation or modification of charge for debentures or rectifying of particulars filed in respect of creating or modifying n of charge for debentures

It is worthwhile mentioning here that if any form that has been due for filing before April 1, 2021, is being filed now, then the same shall be subject to additional fees due to delayed filing. The reason being, the relaxation is granted for the filing of forms that are due for filing from April 1, 2021, to May 31, 2021.

Further, it is brought to the attention that changes that are required in the MCA-21 System to execute the above-mentioned decision are being made and stakeholders shall be informed in due course through a similar notice.