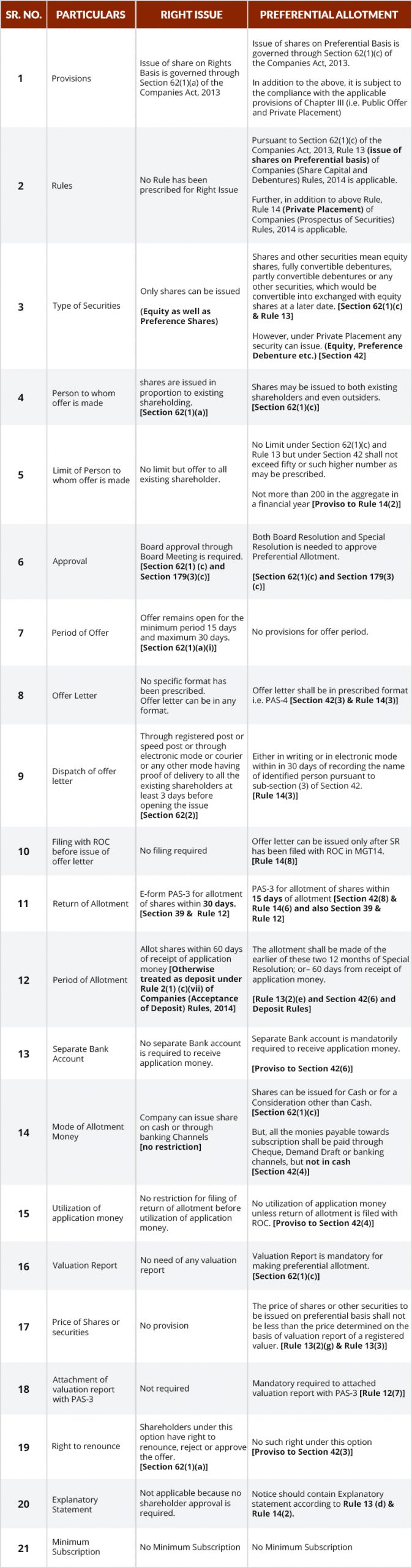

Issue of shares on a preferential basis and issue of share rights basis both come u/s 62 of the Companies Act, 2013, and also in the Companies (Share Capital and Debentures) Rules, 2014, and Companies (Prospectus and Allotment of Securities) Rules, 2014.

This is a formal invitation for existing shareholders regarding the rights issue of shares, allowing them to purchase additional shares in proportion to their current holdings.

In contrast, a preferential allotment involves the issuance of new shares directly to individuals or venture capitalists at a fixed price. The company often seeks strategic investors for these allotments.

This opportunity is also available to financial institutions, venture capitalists, promoters, and current stakeholders who wish to increase their ownership in the company.

The company gives the power to the stakeholders for a higher allotment and creates value addition.

Let’s discuss both types of share issues as well as their differences in detail here.

What is the Rights Issue?

This is a type of share allotment under which a company offers its existing shareholders an opportunity to buy additional shares, in proportion to their shareholding, at a discounted price from the market rate.

Benefits of Rights Issue:

What is Preferential Allotment?

Preferential allotment refers to the issuing of shares or other securities, such as equity shares, partly or fully convertible debentures, and any other securities that could be converted into equity shares at a later date, by a company to a specific person or group, on a preferential basis.

Under this type of allotment, bulk shares are allotted to a preferred group of people. This option is suitable for institutional shareholders who want to buy large amounts of shares of a company. These can be groups of individuals, venture capitalists, companies, or any dedicated personnel from a company.

Benefits of Preferential Allotment:

If you need professional help or consulting for share issues, buyback, Rights issues, preferential allotment, and other Registrar & Transfer Agent Services, feel free to contact SAG RTA.

Rights Issue V/S. Preferential Allotment: Difference Explained

Now that you have a general idea about the Rights Issue and Preferential Allotment, let’s talk about the differences between the two.

As we already mentioned before, the main difference between Rights Issue and Preferential Allotment is that Rights Issue is offered to the company’s existing shareholders.

Now, let’s talk about the Procedure for Rights Issues and Preferential Allotment

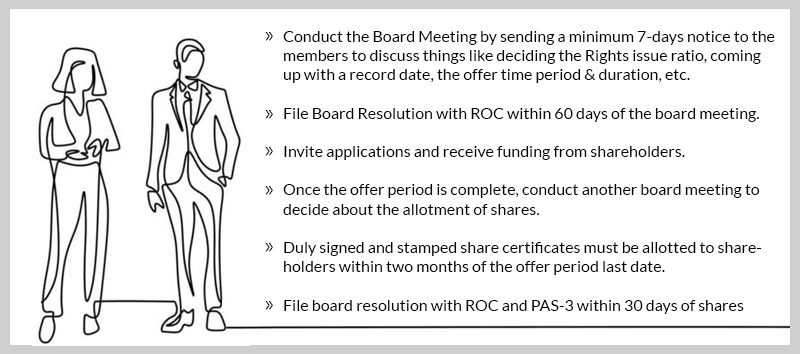

What is the Procedure for the Rights Issue?

The following is the step-by-step procedure for the Rights Issue:

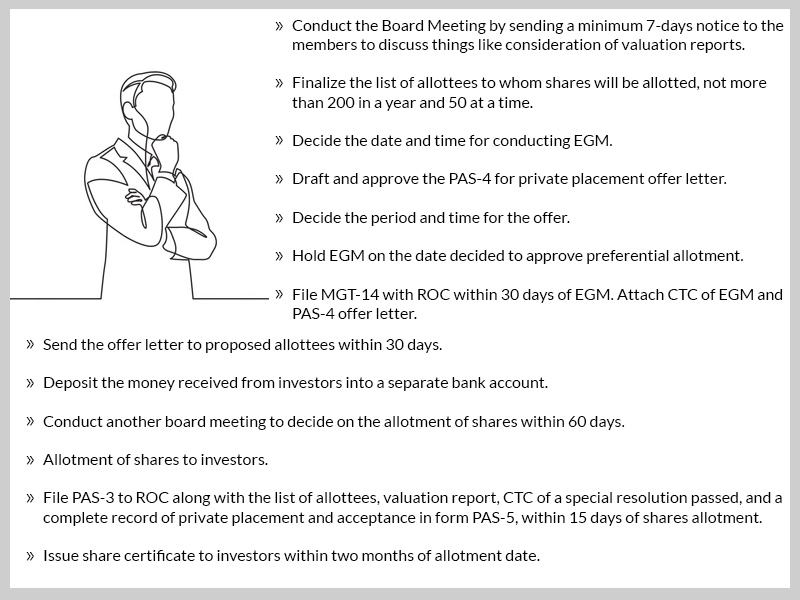

What is the Procedure for Preferential Allotment?

The following are the steps to the Preferential Share allotment:

Here, we have clarified the differences between Rights Issues and Preferential Allotment, along with the step-by-step procedure for both.

FAQs About Rights Issues and Preferential Allotment

Q.1 What defines a Preferential Allotment under the Companies Act, 2013?

A Preferential Allotment involves a company issuing shares or other securities to a chosen group, such as promoters, institutions, or key investors on a prioritised basis. It falls under Section 62(1)(c) and Rule 13 of the Companies (Share Capital and Debentures) Rules, 2014.

Q.2 Explain a Right Issue according to the Companies Act, 2013.?

A Right Issue signifies the offering of new shares to existing shareholders in proportion to their current holdings. This mechanism enables current shareholders to maintain their ownership percentage by subscribing. It is governed by Section 62(1)(a) of the Act.

Q.3 What is the core distinction between a Preferential Allotment and a Right Issue?

The primary differentiation rests on investor eligibility and objective:

- A Right Issue targets only current shareholders.

- A Preferential Allotment extends to any person, whether an existing shareholder or an external party.

Moreover, a Right Issue secures capital while preserving ownership ratios, whereas a Preferential Allotment often serves strategic alliances or attracts new investment.

Q.4 Is shareholder approval mandatory for both Preferential Allotment and Right Issue?

Yes, but with distinct requirements:

- For a Right Issue, approval is generally optional unless specified in the articles of association.

- For a Preferential Allotment, a special resolution must be enacted during a general meeting.

Q.5 How is share pricing determined in Preferential Allotment versus Right Issue?

In a Right Issue, the board typically sets the price, often at a discount to the market rate. In a Preferential Allotment, pricing must align with SEBI regulations (for listed entities) or valuation standards outlined by the Companies Act (for unlisted entities).

Q.6 Can individuals who are not shareholders apply for shares in a Right Issue?

No, a Right Issue is restricted to current shareholders. However, shareholders may relinquish their rights in favor of another party, thereby enabling indirect investment.

Q.7 What are the compliance obligations for a Preferential Allotment?

Preferential Allotment necessitates:

- A special resolution from shareholders.

- A valuation report from a registered valuer.

- Submission of e-Form PAS-4 and PAS-3 to the Registrar of Companies.

- Adherence to pricing and lock-in norms, particularly for listed companies under SEBI guidelines.

Q.8 Which method is superior for capital raising: Preferential Allotment or Right Issue?

The optimal choice depends on the company’s specific aim:

- Utilise a Right Issue to fortify equity while preserving existing ownership control.

- Employ a Preferential Allotment to secure strategic investors, promoters, or institutions for growth or restructuring purposes.

Q.9 What are the timeframes for completing a Right Issue and Preferential Allotment?

Right Issue: Must remain open for a minimum of 15 days and a maximum of 30 days from the date the offer letter is issued.

Preferential Allotment: Must be finalised within 60 days from the date of receiving the application money.

Q.10 Are both Preferential Allotment and Right Issue applicable to private and public companies?

Yes. Both mechanisms are available to private and public companies, though public and listed entities face greater compliance, disclosure, and regulatory oversight.