A registrar or transfer agent is a trust or similar financial institution that registers and maintains complete data records of the transactions of investors for the ease of mutual fund companies. So the primary role of the Registrar & Transfer Agent is to maintain records of investors and account balances.

A registrar and transfer agent records transactions, cancels and issues certificates, processes investor mailings and deals with other investor problems (e.g., lost or stolen certificates), confirms that investors receive interest payments and dividends when they are due, and send monthly investment statements to mutual fund shareholders while taking care of details of units, nominee changes, maturity dates, timely performance of mutual funds and everything related to investors.

The Registrar and Share Transfer Agent have the potential to draw investors’ attention to new offers springing up in the market.

In short, investors perform all the activities related to mutual funds through registrars and share transfer agents assigned by the corporation at many branches. RTA take care of the transactions carried out by investors, including buying and selling of shares, updating personal information, exchanging, and switching to other funds.

Read Also: Registrar Transfer Agent Benefits To Mutual Fund House

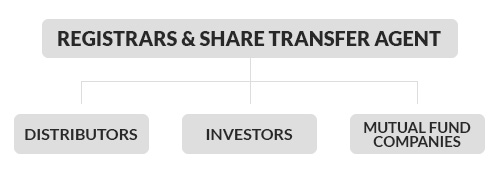

Registrar & Transfer Agent Services to Stakeholders:

The Mutual Fund Consists of Three Stakeholders, Namely:

- Distributors

- Investors

- Mutual Fund Company

Distributors:

A Distributor is an individual or an entity that assists in the buying and selling of units of mutual funds by investors, thereby making their commission-based profits for pulling in investors into the mutual fund schemes.

RTA facilitates distributors by providing sales necessities like forms for investors and various handouts, and by dealing in mutual funds on behalf of their clients. The Registrar and Transfer Agent also provides a complete and detailed statement of the distributors’ sales in any given month.

Investors:

Investors are the individuals who invest their money in mutual fund companies.

The RTA is a one-stop solution for investors regarding all their transactions. RTA makes the trading of mutual funds smooth for investors by providing them with information and service forms and making them aware of new offers, distribution of dividends, maturity dates, various funds, updates, etc. In addition, RTA also conveys synthesized statements to customers regularly.

Mutual Fund Companies:

A mutual fund firm is a company that pools together money from many people and invests it in stocks, bonds, or other assets.

The RTA plays a significant role in mutual fund companies as it cuts down their need to open their branches in places where RTAs are present. Further, Registrar & Share Transfer Agent reduces its cost in the maintenance of records and also supplies synthesized statements to all the customers of mutual fund companies.

Dedicated SAG RTA Team to Handle Client Transactions and Queries

Appoint SAG RTA as Your RTA Service Provider Now

Appoint RTA Agent Now