It might be a complex process to recover the lost physical shares and transfer them to a Demat Account that comprises distinct steps and documentation. An article has been discussed here to assist you with the process.

Step 1: File an FIR (First Document Report)

When you lose your physical shares then the initial step is to file a complaint at your nearest police station and get a FIR. To start the process of recovering the shares the FIR is an important document. It assists you in building a statutory record of the incident and averts any unauthorized transfer or sales of the shares-

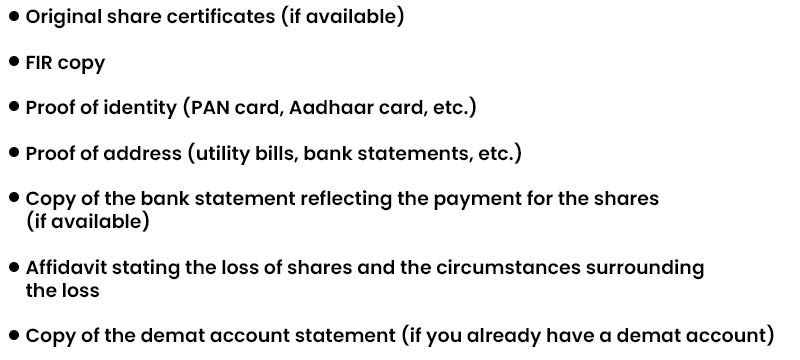

Step 2: Collect Crucial Documents

You shall required to collect the below-mentioned documents to proceed with the recovery and transfer of physical shares to the demat account-

Step 3: Contact the Registrar and Share Transfer Agent (RTA)

Determine the registrar and transfer agent of the company whose shares you have lost. The RTA are obligated to maintain the records of the shareholders and could furnish guidance on the subsequent steps to recover your lost shares. You could determine the RTA’s contact information on the website of the company or via the stock exchange where the shares are listed.

Step 4: Inform the Corporation and Registrar and Transfer Agent

Write a letter or email to the company and the RTA notifying them regarding the loss of physical shares. Add appropriate particulars like the share certificate numbers, distinctive numbers, folio numbers, and any additional details that may assist in determining the shares.

Step 5: Place a Newspaper Advertisement

Post a notice in a widely circulated newspaper in the area where the loss has emerged, citing the loss of the shares and furnishing your contact details. This very step is important to inform the buyers and secure your interest if anyone attempts to sell the lost shares.

Step 6: Receive an Indemnity Bond

You can contact the company or Registrar and Share Transfer Agent to get the format for an indemnity bond. It is a legal document that indemnifies the company against any subsequent claims emerging via the lost shares. Fill in the needed information, sign the bond, and obtain it notarized.

Step 7: Receive a Duplicate Share Certificate

Post finishing the aforesaid steps you are mandated to apply for a duplicate share certificate via the company or the RTA. Provide the below-mentioned documents including the application-

Provide the Indemnity Bond, Affidavit, and Supporting Documents before the RTA provide the notarized indemnity bond, affidavit, and assisting documents before the RTA of the company whose shares you have lost. For the processing of the duplicate share certificates pay any applicable fees.

Step 8: Company Verification

The company or the RTA would verify the submitted documents of you. They may cross-check the particulars with their records and investigate if required.

Step 9: Duplicate Share Certificate Issuance

After finishing the verification the company or the RTA will issue a duplicate share certificate in your name. The same certificate would secure a notation that shows that the same is a duplicate.

Step 10: Open a Demat Account

You are mandated to open a demat account with a registered depository participant (DP) if you don’t have one. As per your preference choose a DP and provide the needed documents, such as PAN card, Aadhaar card, address proof, bank details, and the duplicate share certificate.

Select a Depository Participant (DP) Research and choose a depository participant (DP) that is registered with a depository (such as the National Securities Depository Limited or the Central Depository Services Limited). Consider aspects such as service quality, charges, and reputation at the time of selecting a DP.

Fill out the account opening form contact the selected DP and get the demat account opening form. Fill the form with the precise and complete details, along with personal details, bank account information, and details of the nominee.

Submit KYC Documents Provide Know Your Customer (KYC) documents including with the account opening form. These documents contain proof of identity, proof of address, a copy of a PAN card, passport-sized photographs, and a cancelled cheque.

Complete In-Person Verification (IPV) It is a procedure where your identity is verified in person by the DP or their authorized representative. Go to the office of the DP or schedule a video call for the IPV process.

Sign the Agreement Review and sign the agreement given via the DP. The same agreement shows the rights and obligations of both parties and sets the terms for the demat account.

Pay charges of Account Opening as specified by the DP. These charges may differ depending on the DP and the services proposed.

Once your demat account is opened obtain your Demat account details, the DP will furnish you with the demat account details along with the account number and the additional pertinent details.

Step 11: Submit the Duplicate Share Certificate to the DP

After getting the duplicate share certificates and opening a demat account, transfer shares from the physical to the demat form, you could start the process of transferring your physical shares to the demat form. Follow these sub-steps-

Fill out a Dematerialization Request Form (DRF) Obtain a Dematerialization Request Form (DRF) from your DP or download it from their website. Fill out the form with accurate details, along with the name of the company, folio number, certificate details, and your demat account number.

Provide the DRF and Duplicate Share Certificates Submit the filled DRF including the duplicate share certificates to your DP. Ensure that you make copies of the documents for your records.

Pay the charges of the Dematerialization which may differ as per the DP. The cost of converting the physical shares into electronic form is been covered under these charges.

Await confirmation your DRF and share certificates will get forwarded by your DP to the company’s RTA for verification. Once the RTA validates the documents your physical shares shall be dematerialized and an equivalent number of shares will be credited to your demat account.

Step 12: Share Transfer To Demat Account

Before RTA the DP shall send a request to transfer the shares from the physical form to the electronic form. The RTA would update its records and notify the depository of the transfer.

Step 13: Confirmation and Verification

The information of the share transfer would get validated via depository and update your demat account subsequently. A confirmation statement or transaction statement shall be received to you from the DP showing that the shares are held in your demat account.

Step 14: Track the Demat Account

Keep track of your demat account to ensure that the transferred shares are shown appropriately. You can access your demat account online or ask for periodic statements from your DP.

It is critical to remark that the aforesaid procedure might differ as per the company and the RTA engaged. It is suggested to consult with the statutory professional or ask for guidance via the company’s investor relations department or customer service to ensure compliance with precise needs and any recent modifications in statutes.

Lastly, recovering the lost physical shares and transferring them to the demat account needs filing an FIR, obtaining the required documents, contacting the Registrar and Share Transfer Agent, informing the company, placing a newspaper advertisement, obtaining an indemnity bond, applying for a duplicate share certificate, opening a demat account, submitting the duplicate share certificate to the DP, and completing the process of share transfer.

Throughout this process patience and thoroughness are essential and asking for professional recommendations to navigate any complexities or revisions in regulations could be supportive.